Assessing the Impact of U.S. Tariffs on Financial Markets

Author: The editor's desk

February 3, 2025

Members of AGF’s investment management team provide “rolling” commentary on the potential implications of a brewing conflict between the United States and many of its global trading partners.

(Updated on March 11, 2025 at 3:12 pm)

On Steel and Aluminum Tariffs

- The U.S. administration said earlier today that it will in increase it’s planned tariff on Canadian imports of steel and aluminum to 50% from 25% effective March 12.

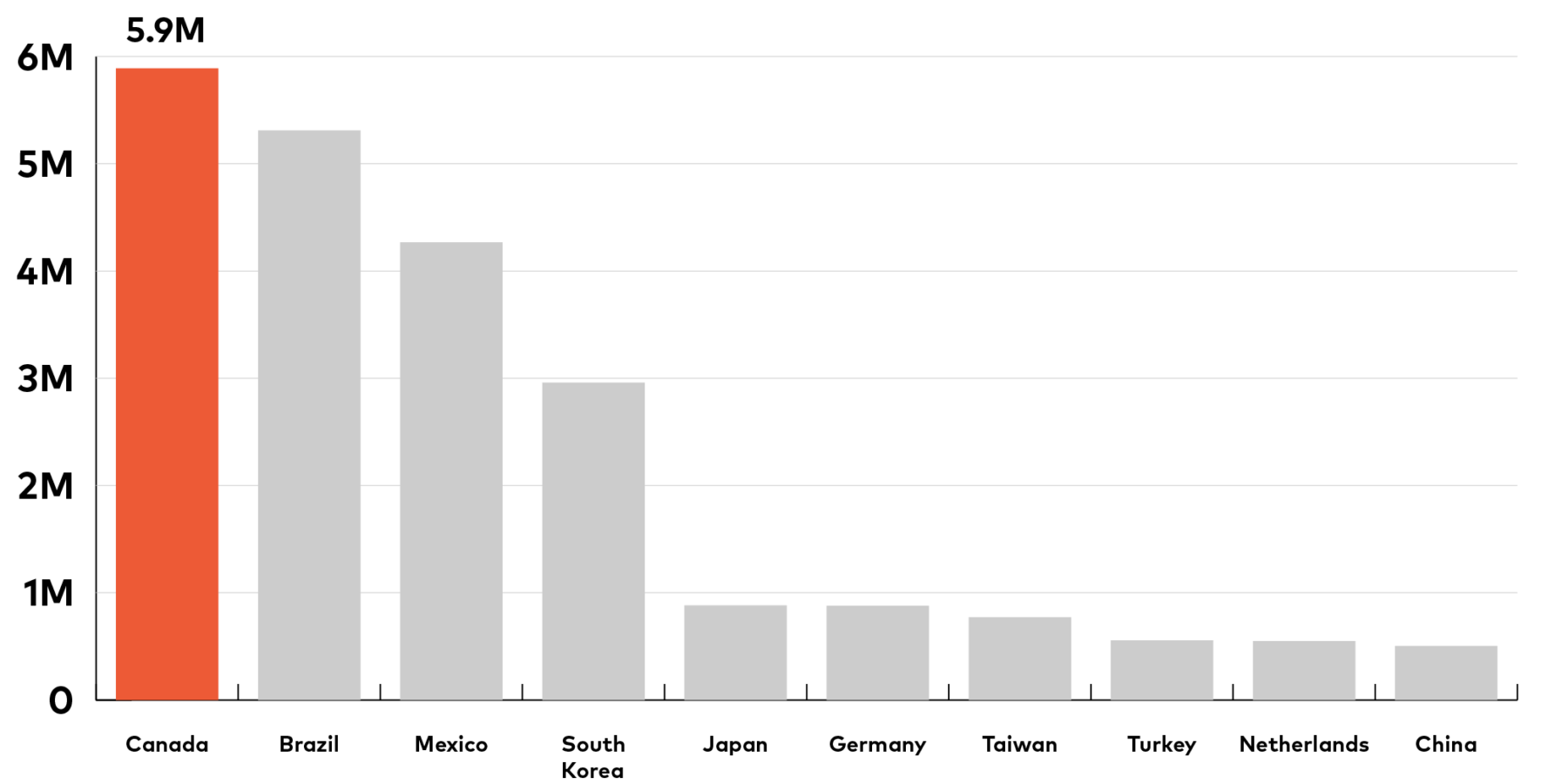

- Canada’s steel products imports represented roughly 21% of all global steel imports for U.S. consumption, based on preliminary data for January from the U.S. Census Bureau (see chart).

- Canada’s aluminum products imports represented 45% of all global aluminum imports for U.S. consumption, based on February figures from the U.S. Department of Commerce.

U.S. Imports for Consumption of Steel Products from Selected Countries (Quantity in Metric Tons. Based on preliminary data for January 2025)

Source: U.S. Census Bureau, February 26, 2025

(Updated on March 7, 2025 at 11:26 am)

On North America’s Auto Industry

- The U.S. administration earlier this week gave a one-month tariff reprieve to automakers covered by the USMCA free trade pact between the United States, Canada, and Mexico.

- This exemption could provide temporary relief for North American auto (and auto-parts) stocks but does not quell the uncertainty or potential impact to the sector entirely.

- An average of 16 million light vehicles are sold in the United States. “Made in USA” vehicles represent between 50-60% of the total, while around 17% (or roughly 3 million vehicles) and 6% (roughly 1 million vehicles) are imported from Mexico and Canada, respectively.

- Auto Original Equipment Manufacturers (OEMs) could see 10-40% of their U.S.-sold vehicles subject to new tariffs (worth close to US$110 billion given the roughly 4 million units of vehicle imports from Canada and Mexico).

- Many U.S. auto assembly lines also use auto parts produced in Canada and Mexico that represent over US$200 billion of imports. If 25% tariffs are to be applied, the U.S. auto industry would be burdened by an incremental US$50 billion or more in costs.

- Specifically, according to estimates from Bank of America and Wolfe Research, potential tariffs could add more than US$3,000 per unit for vehicles sold in the U.S. (assuming the automakers spread the incremental tariff costs across total U.S. vehicle sales).

- That’s close to the entire profit of the automakers in the U.S., meaning that the OEMs would have no choice but to pass on the tariffs to consumers, adding to overall inflationary pressure and leading to market share shift to those less exposed to the new tariff.

- Moreover, we recently spoke with an Asian OEM that has half of their U.S. vehicles made domestically, around 25% made in Canada / Mexico and the remainder from their home country. They said they have no intention to make a meaningful production capacity allocation shift but will pass on higher pricing to consumers for certain models and trims. No new factory is planned in the U.S. as a direct consequence of the tariffs, they said.

Henry Kwok, Senior Analyst, AGF Investments

(Updated on March 6, 2025 at 10:01 am)

On the Canadian Dollar

- In the short-term, we expect to see the Canadian dollar weaken further if most of the U.S. tariffs now in place are not rolled back in days or weeks.

- If the U.S. rolls back all the tariffs, we could see the Canadian dollar rally.

- Longer term, this tariff threat could be a wake-up call for the Canadian government, driving a renewed focus on improving innovation and productivity, as well as diversifying our trade relationships.

Sherry Xu, Foreign Exchange Analyst, AGF Investments

On the U.S. Dollar

- Financial markets haven’t priced in a lasting trade war. If most economies retaliate against the U.S., this could trigger a global growth scare, leading to risk aversion and repatriation from high-beta currencies (Canadian, Australian, emerging markets), which could favour the U.S. dollar.

- Tariff fears have led more economies to unite in decisions on fiscal spending rules.

- Two major economies, Europe and China, which had historically been very reluctant to tap into fiscal room, have announced their intentions to change course to better support their economies.

- This can boost market sentiment on divesting from the U.S. to Europe and Asia, potentially leading to U.S. dollar weakness.

Sherry Xu, Foreign Exchange Analyst, AGF Investments

(Updated on March 5, 2025 at 3:45 pm)

On Steel and Aluminum

- The U.S. has implemented tariffs on global steel and aluminum imports; without exceptions or exemptions. According to the American Iron and Steel Institute, steel imports accounted for approximately 23% of U.S. steel consumption, with the main suppliers being Canada, Brazil and Mexico. With high power requirements to process aluminum, producers have been locating operations in Canada to leverage cheaper hydropower. Canada accounted for nearly 80% of US primary imports of aluminum in 2024.

- In a later move, the U.S has imposed 25% tariffs on imports from Canada and Mexico. These tariffs are additive to the steel and aluminum tariffs in place; making imports of these products from Mexico and Canada carry 50% tariffs.

- Recently, President Trump has made commentary that suggests that a 25% tariff is being considered on copper imports. The U.S. imports roughly 50% of copper consumption from global sources and does not have the capacity to increase internal supply quickly. While potential copper projects exist in the U.S,, these take years to permit and build, and are unlikely to be operational within the term of the current US government.

- All these actions could be expected to permanently move the price of these products and metals higher, which may lead to inflation pressures for many consumer products.

John Kratochwil, Senior Analyst, AGF Investments

On the Energy Sector

- The relative “carve out” for energy in the way of a smaller tariff of 10% highlights the importance of the energy relationship between Canada and the United States.

- Approximately 60% of U.S. energy imports are from Canada with energy imports from Canada growing steadily over the past decade despite a resurgence in U.S. production.

- Most of U.S production is “light” in nature, which is good for gasoline production but less for other heavier refined products such as diesel and jet fuel.

- The carve out also highlights how the current U.S administration is thinking about the impact of energy prices factoring into inflation with high level officials talking about the importance of keeping downward pressure on crude oil to ensure that inflation can be tamed, even in an environment with tariffs being levied on other goods.

- While eventually the price of crude oil will respond to the typical medley of factors (geopolitics, OPEC policy, global economic health etc.), the tariff discussion is likely going to take on a more cautious tone around energy exports.

Pulkit Sabharwal, Analyst, AGF Investments

(Updated on February 19, 2025 at 5::30 pm)

On Canada’s Trade Relation with the U.S.

- A recent report from National Bank says the entire U.S. trade deficit with Canada is due to Canada’s oil and gas imports.

- National Bank also notes that the U.S. has a trade surplus with Canada in more than 60% of 35 industrial sectors. This is compared to 25% between the Americans and the rest of the world.

- Moreover, National Bank points to an analysis by the U.S, Federal Reserve Bank of San Francisco that shows 66% of imported goods from Canada are intermediate inputs in American production, which compares to a 45% average for other U.S. trading partners.

(Updated on February 12, 2025 at 11:13 am)

On U.S. Trade Deficits (and Surpluses)

- The U.S. administration’s evolving tariff policy seems to be targeting countries with which the U.S. has a trade deficit in goods.

- While Canada, Mexico and China have been the primary targets so far, other countries may be in the crosshairs too (see table).

- Countries with which the U.S. has a trade surplus may not be as vulnerable to U.S. tariffs going forward (see table).

U.S. Trade Deficit by Country (year-to-date as of December 2024)

| Rank | Country | Deficit |

|---|---|---|

| 1 | China | US$295.4 billion |

| 2 | Mexico | US$171.8 billion |

| 3 | Vietnam | US$123.5 billion |

| 4 | Ireland | US$86.7 billion |

| 5 | Germany | US$84.8 billion |

| 6 | Taiwan | US$73.9 billion |

| 7 | Japan | US$68.5 billion |

| 8 | South Korea | US$66.0 billion |

| 9 | Canada | US$63.3 billion |

| 10 | India | US$45.7 billion |

| 11 | Thailand | US$45.6 billion |

| 12 | Italy | US$44.0 billion |

| 13 | Switzerland | US$38.5 billion |

| 14 | Malaysia | US$24.8 billion |

| 15 | Indonesia | US$17.9 billion |

Source: United States Census Bureau as of February 18, 2025

U.S. Trade Surplus by Country (year-to-date as of December 2024)

| Rank | Country | Surplus |

|---|---|---|

| 1 | Netherlands | US$55.5 billion |

| 2 | Hong Kong | US$21.9 billion |

| 3 | United Arab Emirates | US$19.5 billion |

| 4 | Australia | US$17.9 billion |

| 5 | United Kingdom | US$11.9 billion |

| 6 | Panama | US$10.1 billion |

| 7 | Brazil | US$7.4 billion |

| 8 | Belgium | US$6.3 billion |

| 9 | Dominican Republic | US$5.6 billion |

| 10 | Guatemala | US$4.7 billion |

| 11 | Bahamas | US$3.8 billion |

| 12 | Egypt | US$3.5 billion |

| 13 | Morocco | US$3.4 billion |

| 14 | Singapore | US$2.8 billion |

| 15 | Paraguay | US$2.8 billion |

Source: United States Census Bureau as of February 18, 2025

(Updated on February 12, 2025 at 3:46 pm EST)

On Monetary and Fiscal Policy (and Bond Markets)

- Additional rate cuts in Canada and the United States are widely expected sometime later this year.

- We believe U.S. tariffs could accelerate the pace of rate cuts in Canada depending on their scope, yet the magnitude of any potential cuts may pale in comparison to those that occurred in response to the global pandemic.

- The Bank of Canada said recently that monetary policy has a limited role to play in a trade dispute, while analysis from several commercial banks indicates the BoC may deliver some relief (via rate cuts) if U.S. tariffs result in weaker economic growth in Canada.

- The U.S. Federal Reserve (Fed) seems in no rush to cut rates further and may stand pat until later in the year given the resilience of the U.S. economy and the potential for U.S. tariffs on imports other countries to result in higher inflation.

- A more dovish Fed (i.e. cuts rates sooner) could also be reasonably expected, particularly if U.S. growth slows meaningfully from the effect of retaliatory tariffs on U.S. goods being exported to other countries.

- We believe targeted fiscal policy may be more effective at providing economic relief to countries embroiled in a prolonged trade conflict. Perversely, this could be partially funded by retaliatory tariffs, which may only ratchet up tensions further.

- We remain cautiously optimistic on fixed income assets, with a preference for longer duration government bonds that may benefit from downward pressure in the long end of the yield curve should economic growth concerns arise. Within credit, we favour defensive sectors with domestic business models.

AGF Fixed Income Team, AGF Investments

On U.S. Manufacturing

- We expect a 25% U.S. tariff on steel and aluminum imports could have both positive and negative effects on the U.S. manufacturing sector.

- U.S. steel and aluminum companies may benefit initially by increasing demand for U.S. produced metal, leading to higher prices; however, about 25% of U.S. steel and 50% of aluminum are imported, with Canada being the leading supplier of both metals.

- The U.S. sectors most reliant on imported steel include construction, automotive, energy, aerospace and defense, appliances, and transportation.

- Higher tariffs could increase production costs for these manufacturers, potentially leading to reduced hiring or layoffs if costs cannot be absorbed or passed on to consumers.

- This could result in higher inflation and slower economic growth, negatively impacting job creation across the manufacturing sector.

- The job losses in downstream industries will more than outweigh the gains in domestic steel and aluminum production.

- The U.S. steel and aluminum industry employs about 300,000 people directly, while the U.S manufacturing industry employs almost 13 million people.

- Internationally, other countries might retaliate with their own tariffs, reducing U.S. exports and affecting jobs in industries dependent on international trade.

- Overall, while tariffs might create jobs in protected industries, we believe they could lead to broader economic challenges that negatively impact U.S. manufacturing employment in the long term.

Wai Tong, Senior Analyst, AGF Investments

(Updated on February 11, 2025 at 10:29 am EST)

On Food and Drink

- Tit-for-tat tariffs between the U.S. and its closest neighbours (Mexico and Canada) could have a large impact on food and beverage costs, a portion of which would likely be passed onto customers through price increases.

- For U.S. consumers, this could mean higher prices on food items like beef imported from Canada and fruits and vegetables imported from Mexico, including avocados, limes, tomatoes and cucumbers that may have a direct impact on both dine-in and fast casual restaurant franchises.

- Imported alcohol such as beer, tequila and Canadian whisky may also be affected by potential U.S. tariffs, leading to higher prices in the U.S. for them as well.

- The potential of retaliatory tariffs being imposed by Mexico and Canada on U.S. imports could likewise affect prices for consumers in these countries. Namely, Mexican consumers may see higher prices for chicken and pork, while Canadian consumers may pay more for things like bourbon and orange juice.

Abhishek Ashok, Analyst, AGF Investments

On Real Estate

- If the goal of tariffs is to drive manufacturing to the U.S., this could impact industrial warehouse demand.

- Interest rates in impacted countries may have to be increased over time to offset inflationary pressures, which would affect the ability for real estate companies to borrow money.

- If building materials increase in price due to the tariffs, this would affect construction costs, and therefore could potentially negatively impact the economics of new construction projects.

John Kratochwil, Senior Analyst, AGF Investments

(Updated on February 4, 2025 at 5:11 pm EST)

On European Equities

- The new U.S. administration has focused its tariff threats mostly on Canada, Mexico and China to date, but Europe may be in its sights as well.

- We believe any U.S. tariffs imposed directly on Europe would depress the outlook for domestic-orientated European stocks, many of which are already negatively impacted by the lack of economic growth in Europe.

- This may lead the European Central Bank to cut interest rates more than expected, which would have a negative impact on the banking sector.

- Some European companies with supply chains in North America may also be impacted by any U.S. tariffs that could still be implemented on Canadian and Mexican imports despite being postponed on Monday. This could encompass industries such as Autos, Capital Goods, Steel, Building Materials and Beverage Makers.

- The MSCI Europe Index has outperformed its U.S. counterpart so far in 2025 and a positive start to fourth quarter earnings season may help assuage U.S. tariff fears for now.

Richard McGrath, Portfolio Advisor, AGF Investments

On China and U.S. Consumer Durables Stocks

- New U.S. tariffs on Chinese imports that came into effect earlier today may not have the same effect on U.S. consumer durables stocks as the 2018/19 round of tariffs from U.S. President Trump’s first term.

- U.S. consumer durables producers have diversified their China-centric sourcing to now include Asian countries such as Vietnam, India, Indonesia, Cambodia, Thailand and Bangladesh.

- As such, some categories such as athletic footwear should see minimal impact on any incremental tariff being levied on China (with exceptions).

- There are categories of U.S. imported goods that still have a sizeable exposure to China, namely appliances, furniture, fashion apparel, toys, value goods sold at dollar stores, and after-market auto parts.

Henry Kwok, Senior Analyst, AGF Investments

(Updated on February 4, 2025 at 9:33 am EST)

On Equity Markets

- Following a volatile start to the week, equity investors may get some relief now that the U.S. administration has agreed (as of late Monday afternoon) to delay tariffs on Canadian goods entering the U.S. for at least the next month. In return, Canada’s government has agreed not to retaliate with its own suite of tariffs on U.S. goods entering Canada.

- This follows a similar agreement made earlier on Monday between the U.S. and Mexico postponing U.S. tariffs on Mexican imports (also for one month).

- Despite these delays, the U.S. plan to slap new 10% tariffs on Chinese goods went into effect Tuesday morning. China retaliated soon after with its own tariffs on select U.S. goods.

- We expect equity markets in North America to remain choppy until a final resolution on tariffs is reached between the U.S., Canada and Mexico in the coming days, weeks or even months ahead.

- More broadly, U.S. tariffs on Chinese goods (and retaliatory measures by the Chinese government) may continue to effect global stock prices in the days ahead, as could the potential for new tariff measures between the U.S. and the European Union.

John Christofilos, Chief Trading Officer, AGF Investments

(Updated on February 3, 2025 at 3:59 pm EST)

On Materials

- Lumber: There is already an anti-dumping duty on Canadian lumber going into the U.S. Adding another 25% tariff makes Canadian lumber uneconomic at current levels. The U.S. produces enough lumber to supply approximately two thirds of their demand, but the remaining one third comes from Canada. There is potential for lumber prices to go up.

- Mining: We expect the impact of tariffs is likely to be little. In a global economy, raw product from Canada and Mexico could theoretically be sold elsewhere geographically with material from another country being sold to the U.S. Mining is not an industry which can suddenly ramp up production, so for metals like copper, the U.S. will remain reliant on global copper supply.

- Steel and aluminum: There is a lot of steel and aluminum which crosses the Canada/U.S. border in both directions. There are several U.S. companies with operations in both Canada and the U.S, so tariffs could impact their profitability. Producers which have 100% of production in the U.S. would benefit from tariffs.

- Packaging: Increased lumber costs would also increase pulp costs, so inputs would increase. If tariffs are put in place, one must wonder about price inflation on food and consumer good, squeezing already stretched finances, and therefore leading to a lower spending environment. Lower consumption of consumer goods would potentially lead to lower packaging demand.

- Cement/Concrete: We don’t expect major impacts. Generally speaking, these products tend to be locally produced and don’t travel long distances, so very little moves across the Canada/U.S. border. There is movement of cement across the Mexico/U.S. border, so there may be some Mexican companies who would be affected by tariffs if they are, in fact, enacted a month from now.

- Chemicals: The chemicals space is generally reliant on oil and a tariff war could increase oil pricing. Similar to packaging, inflation could lead to lower consumer consumption, and could therefore impact demand for goods which are chemicals-based.

John Kratochwil, Senior Analyst, AGF Investments

(Updated on February 3, 2025 at 2:55 pm EST)

On the Canadian Dollar

- Canadian dollar weakness is likely to continue if the hardline stance on tariffs continues. Our long-standing views on this are that the U.S. dollar versus the Canadian dollar could see at least $1.50, but there could be potential upside to this figure.

- If Canada can achieve a tariff pause as Mexico did earlier today, this could help stabilize the Canadian dollar, and we perhaps could see some modest appreciation.

- There is a possible risk that the Bank of Canada delivers an intra-meeting cut which might trigger some additional softness in the Canadian dollar.

- Tariffs are a growth risk to the U.S. economy. The U.S. dollar has been enjoying a bull run partly due to the relative strength of the U.S. economy. We anticipate a threat to this economic exceptionalism would curb U.S. dollar appreciation, at least slowing its ascent.

Tom Nakamura, Currency Strategy and Co-Head of Fixed Income

On the Energy Sector

- Canada’s energy sector fared relatively better than other Canadian sectors given the difference in magnitude of tariffs enacted by the U.S. administration on Canadian imports. (10% on energy vs. 25% broadly on all other exports).

- The move to limit energy tariffs underlines the importance of Canada’s “heavier” blend of oil, which is necessary to produce the different kinds of petroleum products used by U.S. industries and not easily replaced given U.S production leans towards “light” and is better for producing gasoline and kerosene.

- Historically, oil from Mexico and Venezuela could have been used as a replacement but Venezuelan production has seen a precipitous decline since 2014 with limited ability to grow without significant investment, and Mexican production is being increasingly used internally.

- We expect that the additional costs imposed by the tariffs will be shouldered by both Canadian producers and U.S. refiners.

- A drop in the Canadian dollar (versus the U.S. dollar) may shield Canadian producers from some of this impact (but has no impact on U.S. refiners).

- Regardless, it seems clear that the addition of tariffs will add upward pressure to gasoline and diesel prices in the U.S.

Pulkit Sabharwal, Analyst, AGF Investments

On the Bank Sector

- We believe banks are a levered play on the economy and are likely to be affected by economic uncertainty and supply chain disruptions that may result from a protracted period of tariffs between the U.S. and its trading partners.

- Canadian and Mexican banks should be more exposed than the U.S as those economies are likely to have a more downgraded economic outlook. We expect this could manifest as larger provisions for credit losses and slower loan growth, which in turn could lead to lower earnings per share (EPS) growth projections.

- Canadian banks are well capitalized, so fallout for them may be reserved to an earnings growth headwind.

- Canadian banks with large exposure to the U.S may benefit from a weaker Canadian dollar (versus U.S. dollar) when translating their earnings, which should be a meaningful offset.

- We continue to expect a friendlier regulatory environment for U.S. banks, with leadership changes having already taken place at the Committee for a Responsible Federal Budget (CFRB) and Federal Deposit Insurance Corporation (FDIC), and those at the Officer of the Comptroller of the Currency (OCC) and the U.S. Federal Reserve (Fed) possibly still to come.

- The new head of FDIC has already stated that he’s looking to streamline bank capital rules and support bank mergers and acquisitions, however, U.S. loan growth has been lackluster, and the tariff uncertainty may hurt some companies’ intentions to invest at least in the near term.

Marko Kais, Analyst, AGF Investments

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced from Bloomberg, Reuters and other news sources unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of March 7, 2025. It is not intended to address the needs, circumstances, and objectives of any specific investor. The content of this commentary is not to be used or construed as investment advice, as an offer to buy or sell any securities, and is not intended to suggest taking or refraining from any course of action. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments Inc. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

This blog may contain links to third-party websites. The parties who own, maintain or control third-party websites are solely responsible for their content, and AGF assumes no responsibility for such content. Links to third-party websites are provided for convenience only and are not to be construed as an endorsement or recommendation of the products, services, advice or information that may be available on them.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

For Canadian investors: Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

Investment advisory services for U.S. persons are provided by AGFA and AGFUS. In connection with providing services to certain U.S. clients, AGF Investments LLC uses the resources of AGF Investments Inc. acting in its capacity as AGF Investments LLC’s “participating affiliate”, in accordance with applicable guidance of the staff of the SEC. AGFA engages one or more affiliates and their personnel in the provision of services under written agreements (including dual employee) among AGFA and its affiliates and under which AGFA supervises the activities of affiliate personnel on behalf of its clients (“Affiliate Resource Arrangements”).® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.

RO:20250103-4212019

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2026 AGF Management Limited. All rights reserved.