Narrow No More: Why Canadian Equities Might Have an Advantage as Rates Ease

Author: Stephen Duench

October 17, 2024

The “great broadening” of financial markets may have begun, and investors in Canadian equities could be among the most significant beneficiaries.

This would be a big reversal of fortune. In global markets, the headline for much of the past three years has been the concentration of returns among a few big names, especially the so-called Magnificent Seven—Apple Inc., Meta Platforms Inc., NVIDIA Corp., Microsoft Corp., Alphabet Inc., Amazon.com Inc., and Tesla Inc. In a higher interest rate environment, that handful of U.S. mega-cap tech stocks, which comprise about a third of the benchmark S&P 500 Index’s market capitalization, delivered outsized returns. In fact, through November 2023 of last year, all of the S&P 500’s year-to-date positive return was generated by the Mag 7 – the other 493 stocks in the index had a combined negative return.

This narrowing of the stock market was not just a sectoral phenomenon – it was also geographical. As the American tech giants soared, markets in other major economies, including Canada, lagged behind. The reason: higher interest rates.

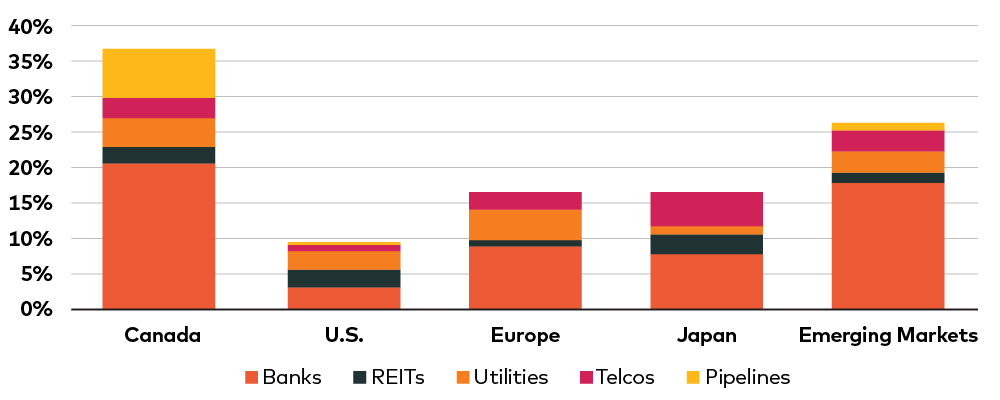

Taken as a whole, non-Magnificent Seven companies in the S&P 500 and in other regions’ equity markets are far more sensitive to rising rates, simply because of the greater presence of interest-rate-sensitive sectors like banks, real estate investment trusts (REITs), telcos and utilities. These sectors are sensitive to interest rate movements because, on the one hand, they tend to be more highly leveraged and higher rates raise their cost of capital, impacting earnings; and on the other hand, companies in these sectors also tend to be dividend-payers, and the relative value of dividend yields goes down as interest rates rise. The chart below illustrates the regional differences in rate sensitivities:

Interest Rate “Sensitives” By Region

Source: AGF Investments using Bloomberg LP data as of October 10, 2024. Interest-sensitive sector weightings established using the following global indexes: S&P/TSX Composite Index (Canada), S&P 500 Index (U.S.), MSCI Europe Index (Europe), MSCI Japan Index (Japan), MSCI Emerging Markets Index (Emerging Markets). One cannot invest in an index. Past performance is not indicative of future results.

As that chart clearly shows, Canada’s equity market has a higher proportion of interest-rate-sensitive stocks than any of the world’s major regions. It follows, then, that the Canadian market would be more adversely affected by the higher rate regime of the past two-and-a-half years than others were.

And this is where the potential opportunity comes in. As central banks lower rates – a process that began in Canada in June but has since been started by the U.S. Federal Reserve, too – we would expect markets to broaden out from the so-called Magnificent Seven to other U.S. and Canadian stocks, and we have already seen that begin: in the third quarter, nearly 70% of the 723 companies listed on the S&P 500 Index and S&P/TSX Composite Index (TSX) had returns greater than the S&P 500 Index’s gain of 4.6%. Moreover, just about half of these companies also outperformed the TSX, which returned 10.5% over the same period.

If interest rates continue to fall, we would expect the broadening out of the S&P 500 and TSX to continue, with Canada as a potential prime beneficiary. This may be especially true if central banks in Canada and the U.S. can navigate a soft landing and help keep their respective economies from tumbling into recession.

Of course, there are risks to this outlook. In this uncertain post-pandemic economy, inflation could once again rear its ugly head, prompting monetary policymakers to halt or reverse course on easing. On the flip side of the economic coin, it’s possible that higher interest rates have slowed growth too much and could spark a recession – a prospect that seems more likely for Canada than the U.S. at the moment.

Our base case, however, is that rates will continue to ease over the rest of this year and into 2025. If they do, then it could position the Canadian market very well going forward – and potentially transform its interest-rate-sensitive stocks from laggards into leaders.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Apple Inc., Meta Platforms Inc., NVIDIA Corp., Microsoft Corp., Alphabet Inc., Amazon.com Inc., and Tesla Inc. are current holdings in AGF Investments portfolios as of September 30, 2024. The information contained herein is designed to provide you with general information. It is not intended to be comprehensive investment advice applicable to the circumstances of a particular investor. References to specific securities are presented for illustration purposes only and are not to be considered recommendations by AGF Investments. It should not be assumed that investments in the securities identified were or will be profitable.

Commentary and data sourced from Bloomberg, Reuters and other news sources unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of October 10, 2024. It is not intended to address the needs, circumstances, and objectives of any specific investor. The content of this commentary is not to be used or construed as investment advice, as an offer to buy or sell any securities, and is not intended to suggest taking or refraining from any course of action. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments Inc. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

For Canadian investors: Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

Investment advisory services for U.S. persons are provided by AGFA and AGFUS. In connection with providing services to certain U.S. clients, AGF Investments LLC uses the resources of AGF Investments Inc. acting in its capacity as AGF Investments LLC’s “participating affiliate”, in accordance with applicable guidance of the staff of the SEC. AGFA engages one or more affiliates and their personnel in the provision of services under written agreements (including dual employee) among AGFA and its affiliates and under which AGFA supervises the activities of affiliate personnel on behalf of its clients (“Affiliate Resource Arrangements”).

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.

RO: 20241017-3935629

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2026 AGF Management Limited. All rights reserved.