Seeking Balance Following Market Extremes

Author: Stephen Duench

March 9, 2023

The dramatic rotation in market leadership that defined equity returns during the first month of 2023 has become less acute in more recent weeks, but investors still need to be careful about its influence on portfolio positioning going forward.

Namely, it’s crucial to find a balance between this year’s early winners and losers. For instance, while some investors might want to load up more on outperforming sectors like Information Technology and real estate income trusts (REITs), this may not be prudent given the extreme nature of the outperformance that took place in January.

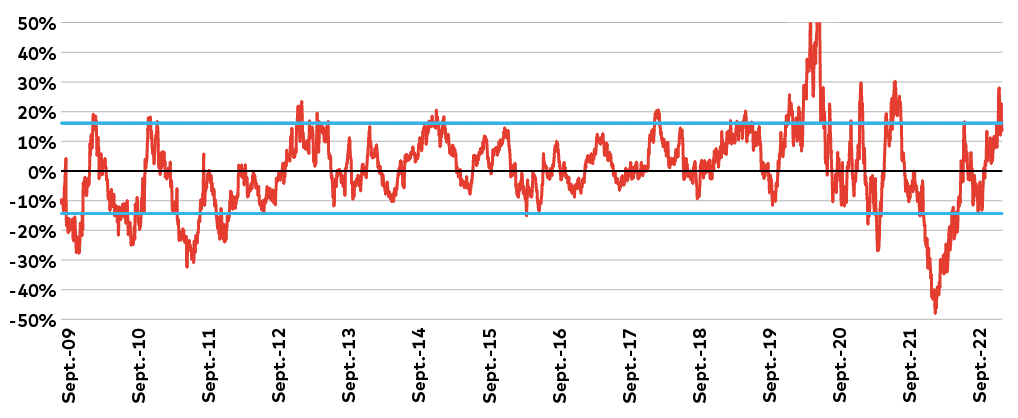

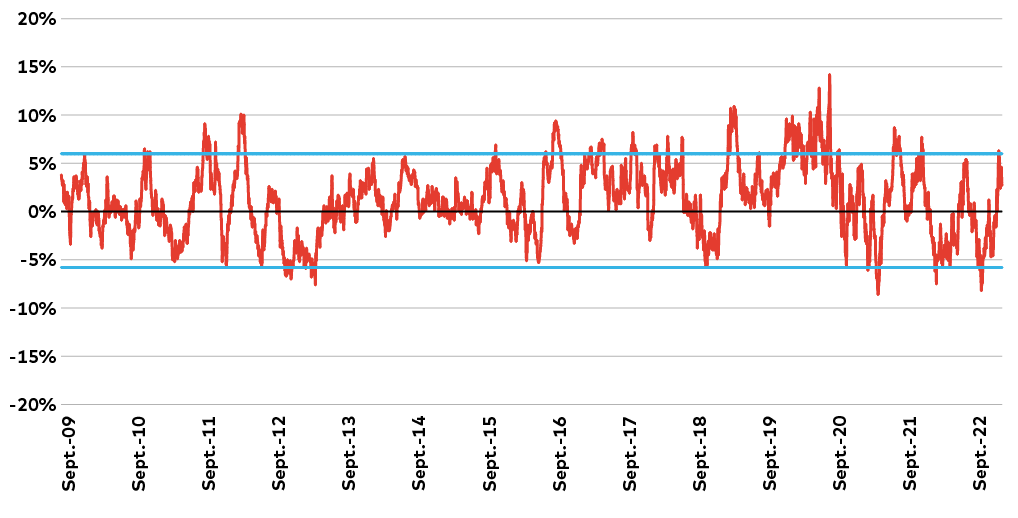

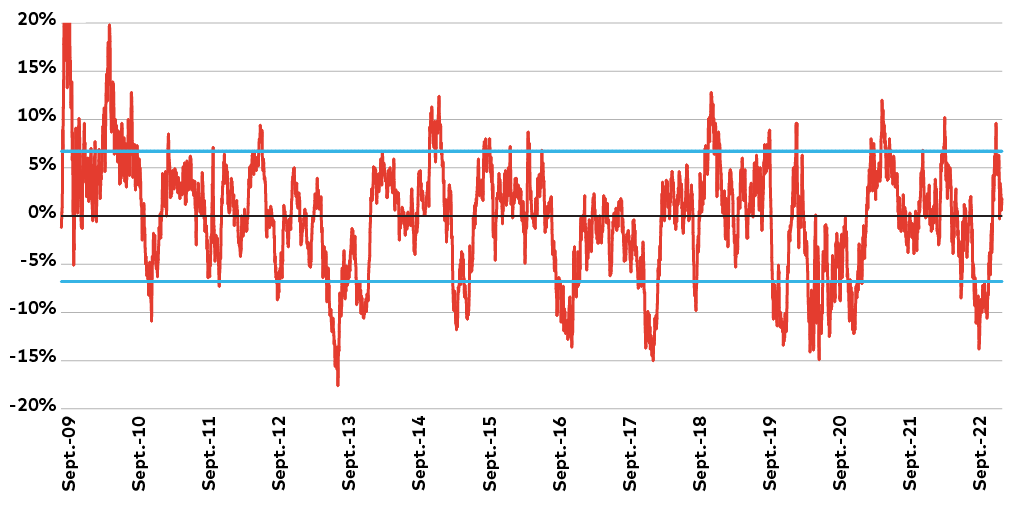

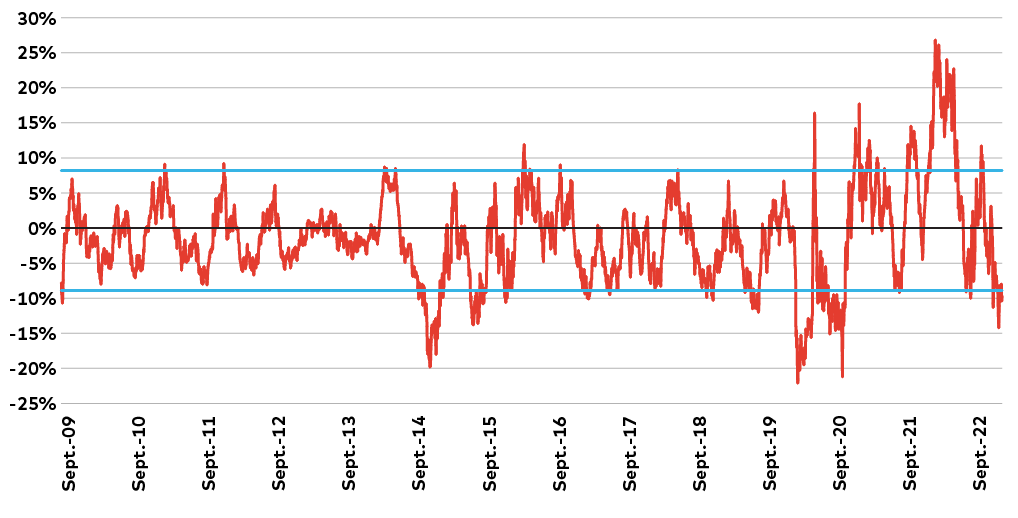

In fact, the rolling three-month relative performance of these two sectors was near or above the “upper bound” level at which future returns begin to wane – relatively speaking – both in Canada and the United States.

Canada Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Information Technology Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Information Technology: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Information Technology Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

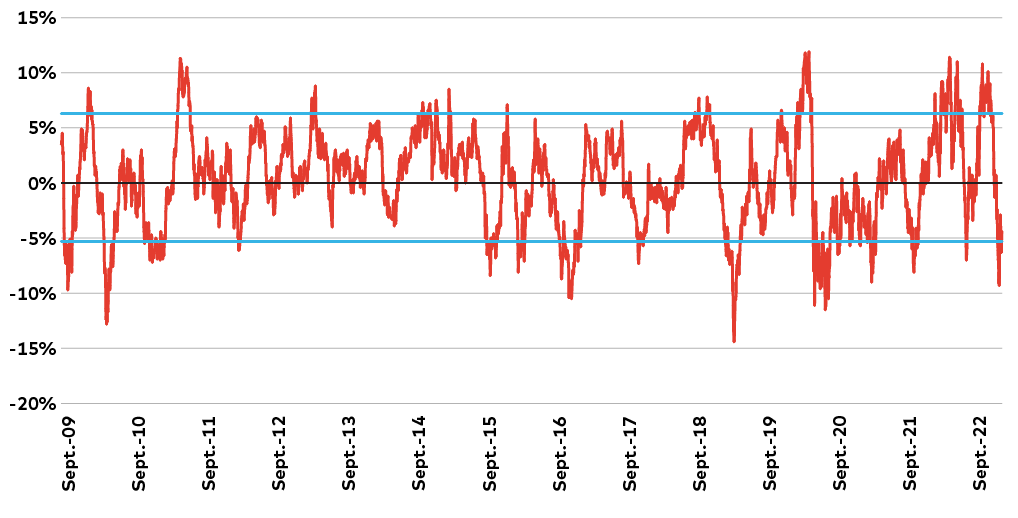

Canada REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX REIT Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. REITs: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P REIT Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

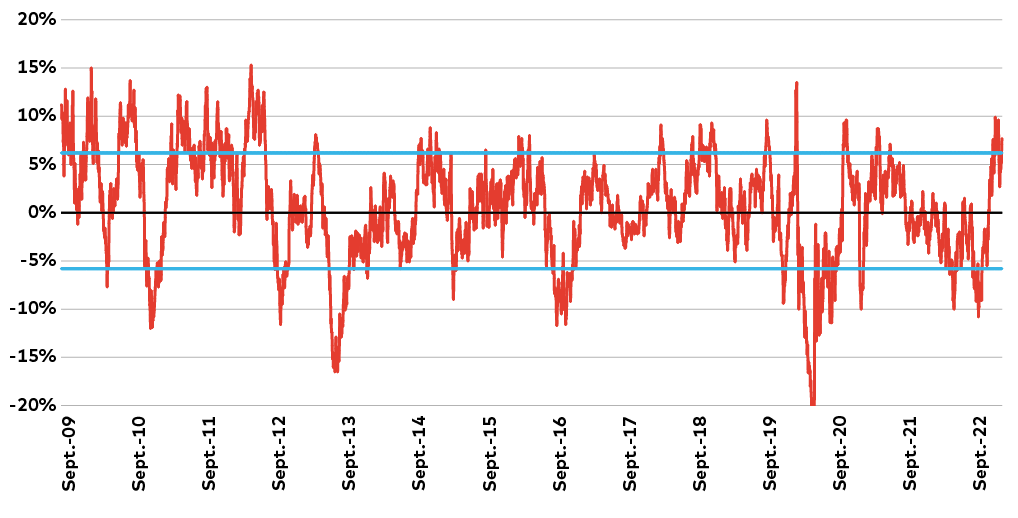

By extension, it’s probably not wise to completely neglect this year’s early losers, which include sectors like Canadian Energy and U.S. Healthcare, both of which underperformed at near or below the “lower bound” level that future relative returns begin to improve.

Canada Energy: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P/TSX Energy Index versus the S&P/TSX Composite Index. One cannot invest directly in an index. Past performance is not indicative of future results.

U.S. Healthcare: Three-Month Rolling Relative Return

Source: AGF Investments Inc. using data from FactSet as of February 21, 2023. Three-month rolling relative return of the S&P Healthcare Index versus the S&P 500 Index. One cannot invest directly in an index. Past performance is not indicative of future results.

To be clear, that doesn’t mean investors should do the complete opposite. Selling all your winners and buying the losers in hopes of a complete reversal in market leadership is a very difficult proposition to make given the uncertainty of the current market environment.

A better approach for many might be a “core and contrarian” strategy that maintains exposure to the strongest performing winners in a portfolio, while adding select laggards that show high conviction quality attributes.

As an example, from a dividend investing perspective, the REITs remain fertile ground for opportunities despite the sector’s outsized gains earlier this year. Moreover, there are several Energy and Healthcare names with great attributes that are even more attractive for having been on the wrong side of the rotation in market leadership. Not only are their yields higher for it today, but they’re also expected to keep growing at a time when dividend growth could become scarce as other companies brace for the potential of a severe economic downturn.

Ultimately, market extremes like those we experienced to start 2023 can be difficult to navigate, but by maintaining a balanced approach, investors are better positioned to navigate the risks, while taking advantage of the opportunities that arise.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of March 1, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2025 AGF Management Limited. All rights reserved.