What De-Dollarization Could Mean for the Greenback

Author: Tom Nakamura

April 24, 2023

The U.S. dollar (USD)’s standing as the world’s dominant reserve currency may seem in jeopardy following reports that Brazil, Russia, India, China and South Africa (i.e., the BRICS) want to create an alternative currency for use by them (as well as other nations) in international trade settlements and global financial operations. But “de-dollarization” is nothing new and even if the trend were to accelerate from here, it is unlikely to have much impact on the greenback’s investment value in the foreseeable future.

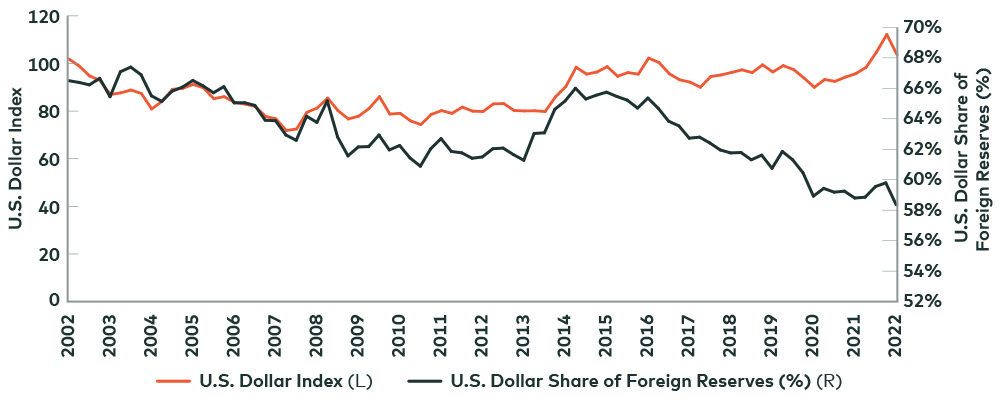

In fact, this may already be evident (see chart 1). Take the U.S. dollar’s share of foreign exchange reserves, for example. It has steadily declined for the better part of the past two decades, yet over that same period, the U.S. Dollar Index – which ranks the greenback against a basket of six other currencies – has remained relatively stable and increased since 2010.

U.S. Dollar’s Share of Foreign Exchange Reserves Has Fallen but the U.S. Dollar Index Has Not

Source: Bloomberg LP. as of April 17, 2023.

That doesn’t mean recent efforts to limit the influence of the U.S. dollar should be ignored. In addition to the BRICS’ alternative currency plans, separate agreements between China and Brazil to settle trades in Chinese yuan, as well as Saudi Arabia’s openness to peg their oil prices to something other than the greenback raise the spectre of a very different landscape for currency markets going forward –especially as it relates to a country’s foreign exchange (FX) reserve policy.

The general theory with reserve management is that the stock of reserves should reflect net foreign obligations, including covering imports. In turn, the more that trade is invoiced in non-USD currencies, the less reason for reserve managers to hold U.S. dollars.

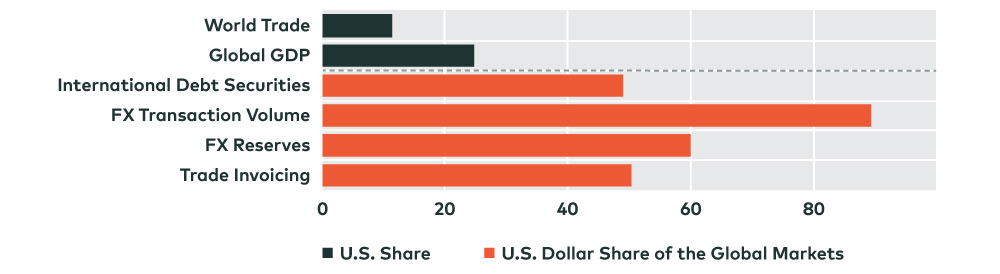

Still, trade is not the only consideration for holding reserves of one currency over another (see chart 2). Liquidity – or how quickly investment securities can be turned into cash – is a principal factor as well. So too is the convertibility of cash into a particular set of currencies that may be needed.

The International Role of the U.S. Dollar

Source: Bank for International Settlements as of December 5, 2022

And while these two factors have arguably become less favorable for the U.S. dollar in relation to countries that have faced sanctions (or fear facing sanctions in the future), no other global currency remains as liquid or convertible as the greenback, which, in our opinion, is also beyond reproach in terms of trust and credibility.

Ultimately, the U.S. dollar’s role as the world’s reserve currency seems secure and its value is unlikely to erode solely because of recent geopolitical developments in support of “de-dollarization.”

Moreover, any future decrease in the greenback’s importance would likely happen over a long period of time and would first require a serious competitor to emerge on the world stage – an eventuality that is much talked about these days, but far from certain and may not exist for some time still to come.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of April 17, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2025 AGF Management Limited. All rights reserved.