Why Last Year’s Stock Market Laggards Are This Year’s Early Winners

Author: Abhishek Ashok

March 3, 2023

Investors were a decidedly bearish bunch at the end of 2022, but that’s no longer the case if the dramatic turn in momentum stocks is the result of the market’s growing confidence at the beginning of this year.

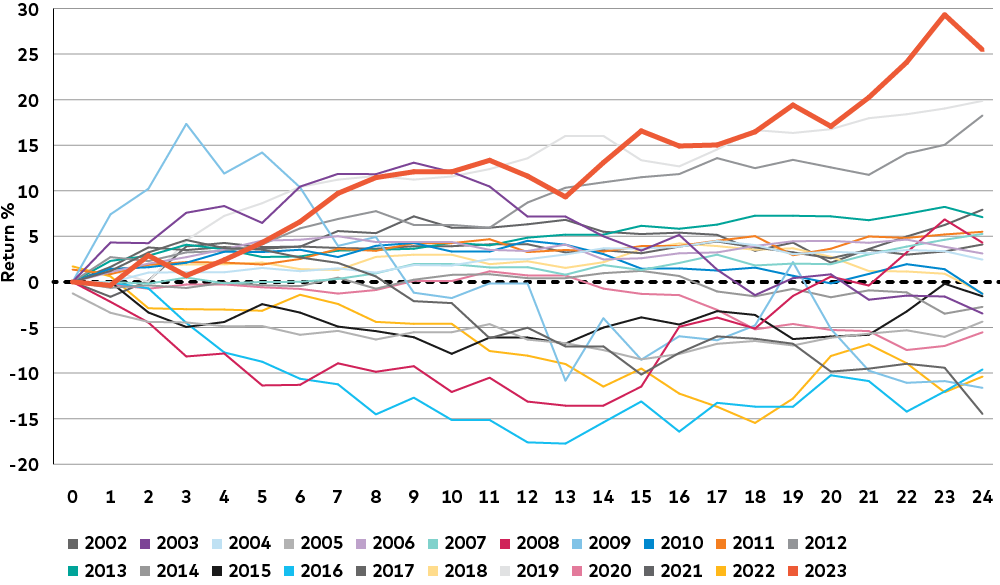

Over the first month of 2023, the rolling one-month performance of last year’s “laggards” – which can be characterized as the basket of stocks exhibiting higher beta, lower quality, high short interest, and expensive valuation profiles – was up close to 18%, representing one of the biggest momentum reversals of the past 20 years. Moreover, the cumulative performance of these laggards was greater over this period than it’s been in any year since 2002, including 2019 and 2013, both of which ended as “up” years for stocks.

Best Year-to-Date for Momentum Laggards in Over 20 Years

Source: AGF using data from FactSet as of February 3, 2023. Cumulative year-to-date return of stocks in the lowest quintile of 12-month price change in the top 1,200 securities in the U.S. by market capitalization.

So, why did the make up of momentum shift so dramatically? Part of the answer lies in the changing narrative about the economy. No longer do investors believe en masse that a recession is imminent like they did just a few months ago. Now some believe an economic contraction is either still months away or that it could be avoided altogether.

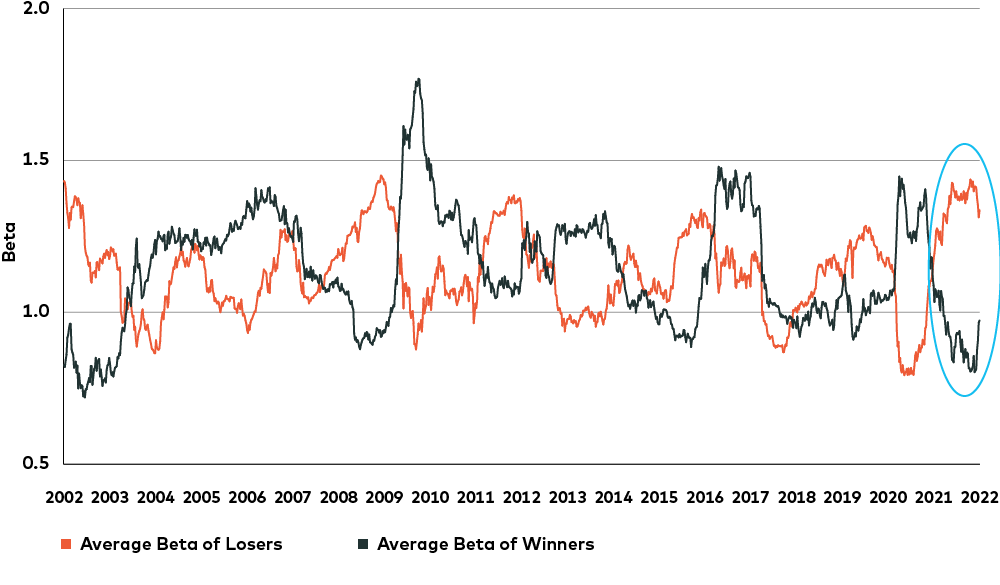

As such, the historically bearish positioning to end last year was bound to unwind. In fact, the average beta of winners and losers have both reverted somewhat toward their norms after ending last year at 20-year extremes.

Average Beta of Stocks Within Momentum Quintiles at 20-Year Extremes

Source: AGF using data from FactSet as of February 3, 2023. Average one-year beta of stocks in the top and bottom quintile of 12-month price change in the top 1,200 securities in the U.S. by market capitalization.

Whether this trend has legs – meaning the outperformance of last year’s laggards continues – likely depends on what the economy actually does in the coming weeks.

Our research shows that Purchasing Manager Indexes (PMIs) typically bottom lower than recent lows following an aggressive central bank tightening cycle like what was experienced last year. That would suggest a deeper slowdown than is now expected and could lead to another reversal whereby last year’s laggards could end up being this year’s laggards again. On the flip side, if PMIs continue to improve from here, the current trend of last year’s laggards outperforming could persist, albeit not likely to the same extreme as earlier this year.

Another likely scenario, however, is for PMIs to ebb and flow from here as the business cycle compresses, much like it did in the mid-1990s and the mid-to-early 2000s. In turn, market leadership may become more muted and defined by short-term reversals that contribute to range-bound asset prices.

Either way, investors need to be cautious about what unfolds in markets going forward. While confidence was on the rise to start 2023, there’s still plenty of economic uncertainty to be nervous about and what worked well to start the year may not be the case in the months ahead.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of February 28, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties, and assumptions that could cause actual results to differ materially from those expressed herein.

References to specific securities are presented to illustrate the application of our investment philosophy only and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by AGF Investments.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2025 AGF Management Limited. All rights reserved.