Big Picture: What the “Smart Money” Says About Private Credit

Author: The editor's desk

July 5, 2022

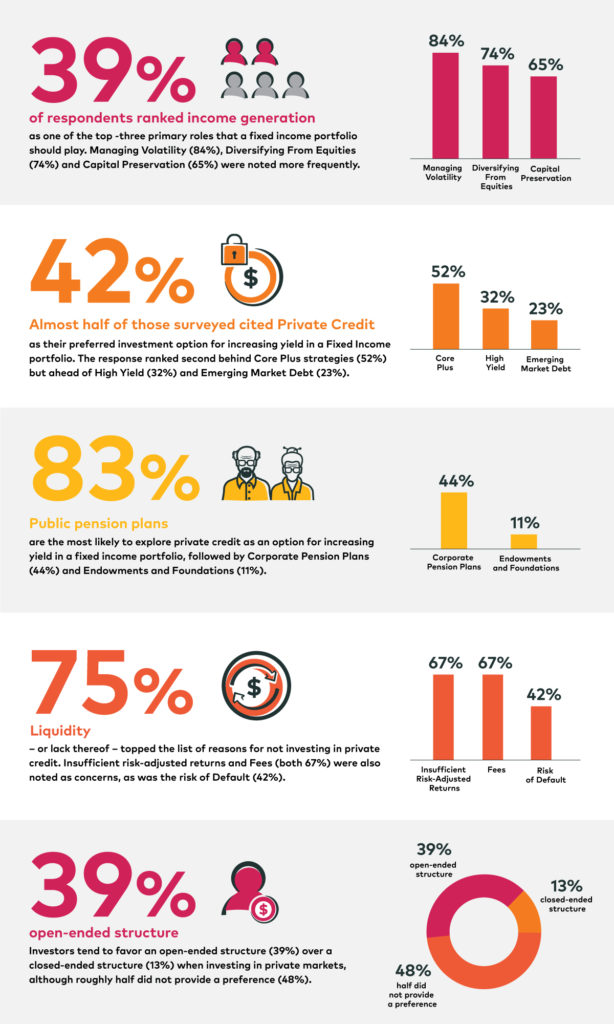

Canadian institutional investors are turning to private credit as one of several potential ways to generate higher fixed income yields, but uptake in the asset class has been circumspect to date and may grow more pronounced in the coming years.

Here are five facts from a new Greenwich Coalition study commissioned by AGF Investments Inc. that highlight what asset owners – from public and corporate pension plans to endowments and foundations – think about private credit and the potential opportunities it affords as part of a diversified fixed income portfolio.

Source: Coalition Greenwich 2022 Fixed Income Investing Study, March 25, 2022.

To read more results from the Greenwich research, please click here.

To read more results from the Greenwich research, please click here.

_____________________________________________________________________________________

The views expressed in this insight based off the 2022 Greenwich Research. The views are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of June 27, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This report is provided for informational purposes only and is not intended to provide specific individual advice including, without limitation, investment, financial, legal, accounting or tax. The comments should not be construed as recommendations to invest in any products or services but rather an illustration of broader concepts.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2024 AGF Management Limited. All rights reserved.