Big Picture: Growth Vs Value

Author: Abhishek Ashok

September 19, 2023

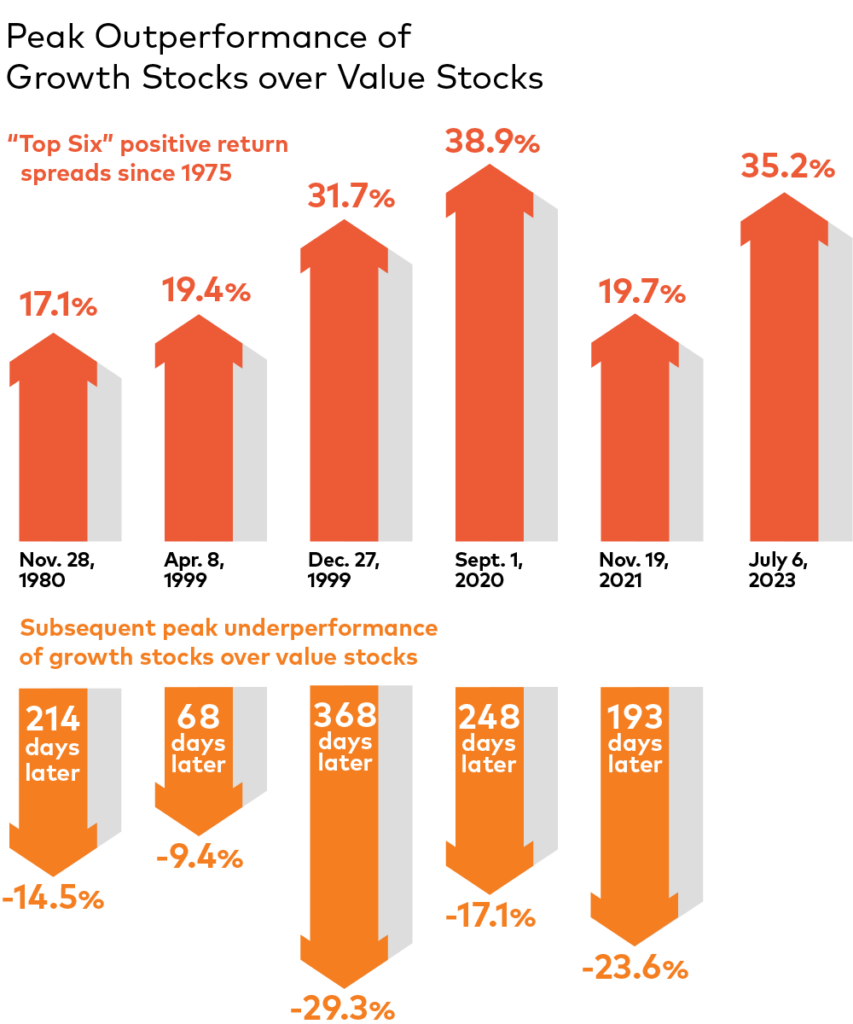

The performance spread in favour of growth stocks has rarely been larger than it was earlier this summer.

Source: AGF Investments using data from Bloomberg LP. Rolling six-month performance spread between MSCI U.S. Growth Index and MSCI U.S. Value Index. Full data set of research calculated from January 1, 1975 to July 31, 2023. Past performance is not indicative of future results, one cannot invest directly in an Index.

It’s no wonder that one of the big stories in equity markets this year has been the outperformance of growth stocks (i.e. shares in companies that are expected to grow their earnings more than average) over value stocks (i.e. shares in companies that are trading at a price less than their intrinsic value).

Indeed, there has only been one other period in the past 50 years that the performance spread between the MSCI U.S. Growth Index and MSCI U.S. Value Index reached as large a margin as it did in early July, when it stood at 35.2% (see graphic above).

But what’s perhaps even more interesting about this dynamic is how quickly the outperformance of growth stocks can dissipate after it hits a peak. For instance, it took less than a year for them to go from outperforming value stocks by almost 40% in the late summer of 2020 to underperforming value stocks by 17% the following spring. And, in 1999, it took just over two months for them to go from outperforming value stocks by 19% to underperforming by almost 10%.

Granted, there’s no guarantee that reversals are set to happen again. After all, the performance of growth and value stocks – like any investment – is largely determined by events and circumstances taking place now or in the future, rather than by repeating what has occurred in the past.

But as Mark Twain reputedly said, “history may not repeat itself, but it often rhymes,” and should growth stocks lose more of their lustre relative to value stocks going forward, investors should hardly be surprised.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced from Bloomberg, Reuters and company reports unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of Sept 1, 2023 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” logo is a registered trademark of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2025 AGF Management Limited. All rights reserved.