Four Markets Face Off

Author: The editor's desk

February 13, 2025

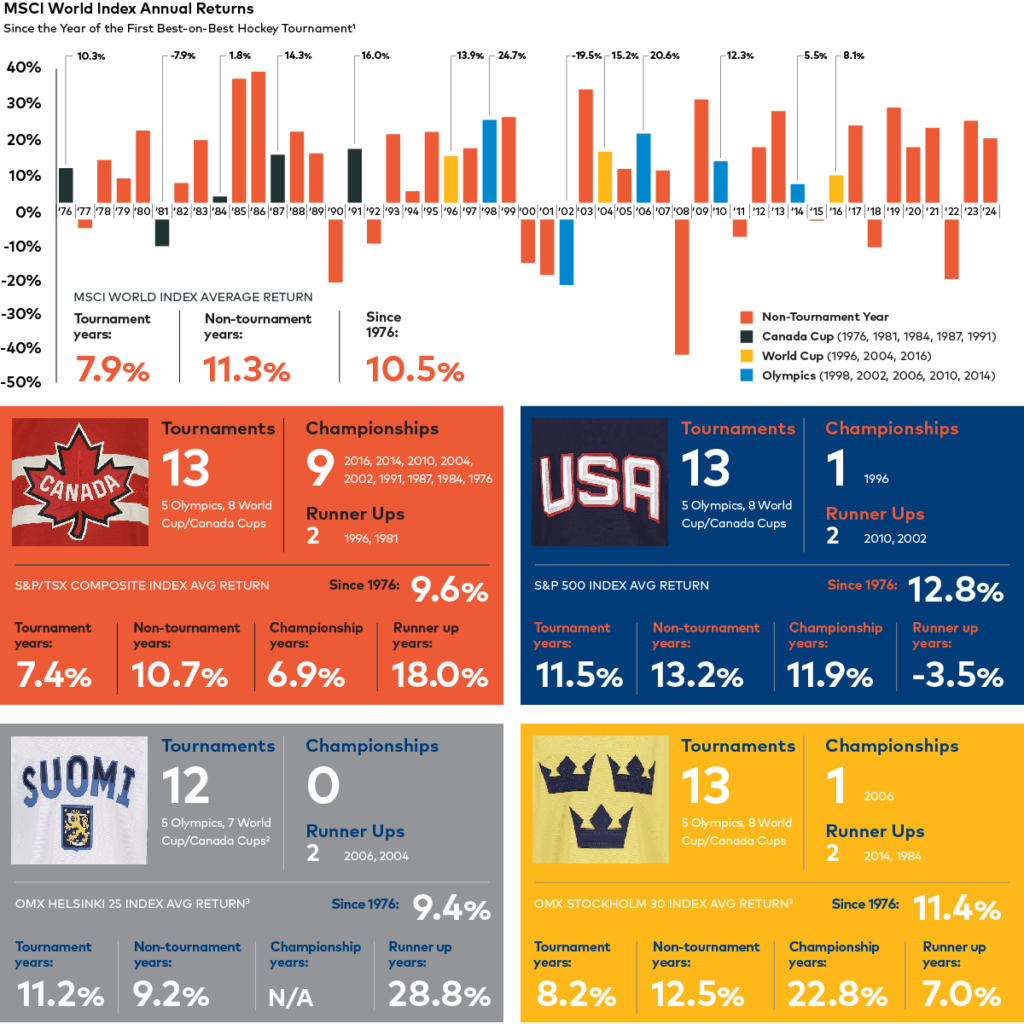

The inaugural Four Nations Face-Off professional men’s hockey tournament is in full swing this week and next. Featuring teams from Canada, Finland, Sweden and the United States, it got us thinking what do winning teams of previous “best-on-best” showdowns in the sport have in common with stock market returns?

The easy (if not so formal) answer is zilch. There is definitively no cause and effect between the two outcomes. And that should come as a big relief for Canadian hockey fans who invest in the S&P/TSX Composite Index and might otherwise feel conflicted about cheering for the home team.

Indeed, the average return for the country’s primary equity index in years that Canada was crowned champion pales in comparison to its average historical return when they were a runner up. But that’s not all. Perhaps adding insult to injury is the fact that the S&P 500 Index in the United States and OMX Stockholm 30 Index in Sweden historically did better on average in the year their national teams won than they did in the years they finished second place.

Granted, maybe there’s a lesson in here about diversification? Diversification of investments, that is. Canadian hockey fans are happy to have best-on-best hockey championships keep piling up, eh?

Source: AGF Investments using Wikipedia and data from Bloomberg LP. as of February 13, 2025. One cannot invest directly in an index. Past performance is not indicative of future results. For illustrative purposes only. There is no cause and effect between index returns and hockey tournaments/championships.

Footnotes:

- For the purposed of this infographic, best-on-best hockey tournaments do not include the Canada/USSR Summit Series of 1972 and 1974 or annual IIHF World Championships. Olympic Games competitions before 1998 and since 2016 were also not included because professional (NHL) hockey players did not participate in them.

- Finland did not participate in the 1984 Canada Cup tournament.

- OMX Finland 25 Index was launched in 1987. OMX Stockholm Index was launched in 1989. MSCI EAFE Index was used as a proxy for these indexes prior to these years. Returns were calculated using current weightings of Finland and Sweden in the MSCI EAFE Index and applied to historical returns of the MSCI EAFE Index.

The views expressed in this blog are those of the author and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

Commentary and data sourced from Bloomberg, Reuters and other news sources unless otherwise noted. The commentaries contained herein are provided as a general source of information based on information available as of February 13, 2025. It is not intended to address the needs, circumstances, and objectives of any specific investor. The content of this commentary is not to be used or construed as investment advice, as an offer to buy or sell any securities, and is not intended to suggest taking or refraining from any course of action. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments Inc. accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained herein.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

For Canadian investors: Commissions, trailing commissions, management fees and expenses all may be associated with investment fund investments. Please read the prospectus before investing. Investment funds are not guaranteed, their values change frequently, and past performance may not be repeated.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFI is registered as a portfolio manager across Canadian securities commissions. AGFA and AGFUS are registered investment advisors with the U.S. Securities Exchange Commission. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The term AGF Investments may refer to one or more of these subsidiaries or to all of them jointly. This term is used for convenience and does not precisely describe any of the separate companies, each of which manages its own affairs.

AGF Investments entities only provide investment advisory services or offers investment funds in the jurisdiction where such firm, individuals and/or product is registered or authorized to provide such services.

Investment advisory services for U.S. persons are provided by AGFA and AGFUS. In connection with providing services to certain U.S. clients, AGF Investments LLC uses the resources of AGF Investments Inc. acting in its capacity as AGF Investments LLC’s “participating affiliate”, in accordance with applicable guidance of the staff of the SEC. AGFA engages one or more affiliates and their personnel in the provision of services under written agreements (including dual employee) among AGFA and its affiliates and under which AGFA supervises the activities of affiliate personnel on behalf of its clients (“Affiliate Resource Arrangements”).

® ™ The “AGF” logo and all associated trademarks are registered trademarks or trademarks of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2026 AGF Management Limited. All rights reserved.