Three Takeaways from the Summer Rally in Stocks

Author: Abhishek Ashok

September 9, 2022

Every month (or so), AGFiQ highlights the investment factors that are helping shape equity markets. Today’s focus includes the risk on/risk off nature of the rebound in stocks and what the PMI cycle means for factor performance going forward.

Risk On, but Not Quite Risk Off

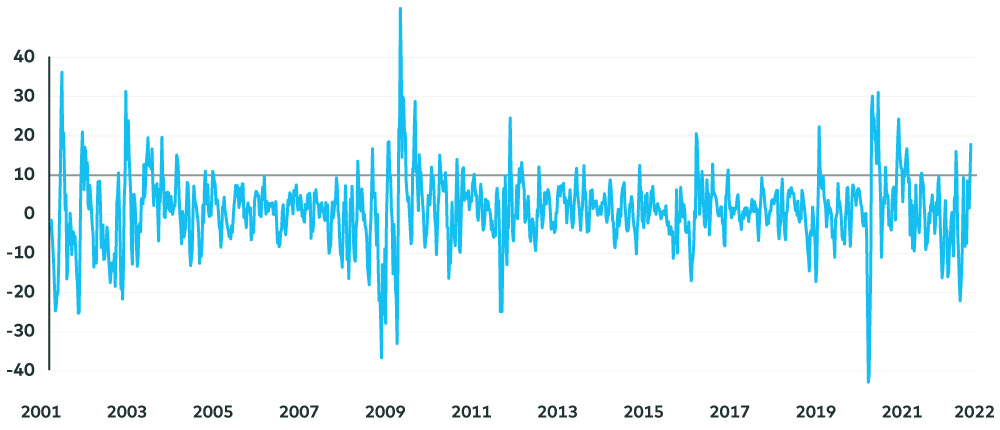

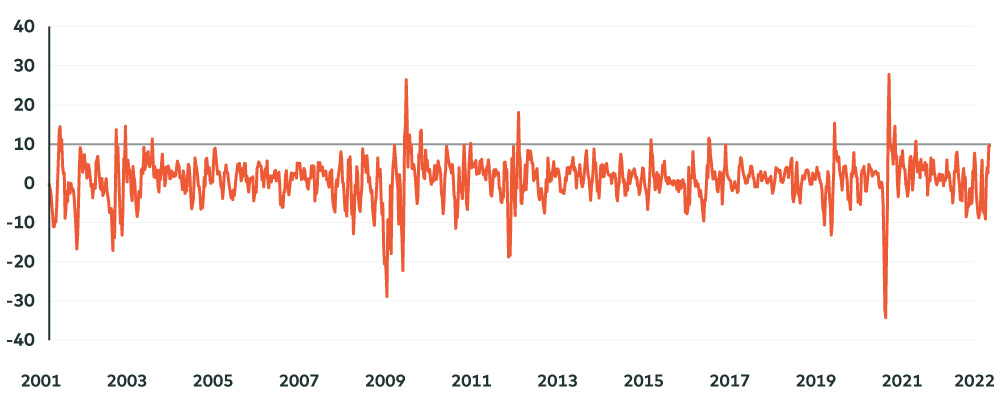

The rally in U.S. stocks from mid-June to mid-August was led by a slew of risk-on names, including small capitalization, low-quality, high-volatility growth companies that outperformed the broader market by roughly 10% on average near the end of July (see illustration 1) and closer to 20% in early August, according to AGFiQ research. But large capitalization, high-quality stocks that are normally associated with more risk-averse positioning did almost as well throughout this period. Moreover, the returns of these two trades at opposites ends of the risk spectrum can be considered extreme based on their larger-than-average deviation from historical performance spreads to the broader market.

Strong Returns on Both Ends of the Risk Spectrum

Small Cap + Growth + Low Quality + High Vol

Large Cap + High Quality

Source: AGFiQ using data from FactSet as of August 10, 2022. One-Month rolling return of stocks in the top quintile based on the respective factors in the top 1,200 securities in the U.S. by market cap.

Trend Versus Trade

Recent market action may be best explained not as a trend that will continue, but as a trade that is typical in the current “slowdown” stage of the Purchasing Manager Index (PMI) cycle. In fact, there tends to be a great deal of back and forth in factor performance when PMI scores have peaked, like they seem to have in several countries over the past few months, but haven’t yet fallen below 50, the line that separates business expansion from contraction. More specifically, there tends to be an initial – and often significant – rotation into low-volatility and low-beta stocks, much like was experienced earlier this year. This knee-jerk reaction is then followed historically by a “beta” bounce, meaning high-beta stocks outperform low-beta stocks in similar fashion to what happened this summer, while overall factor positioning becomes a bit more neutral until the PMI cycles transition further and mark a business cycle recession. It’s also true historically that quality and growth tend to do better than other factors near the end of this process.

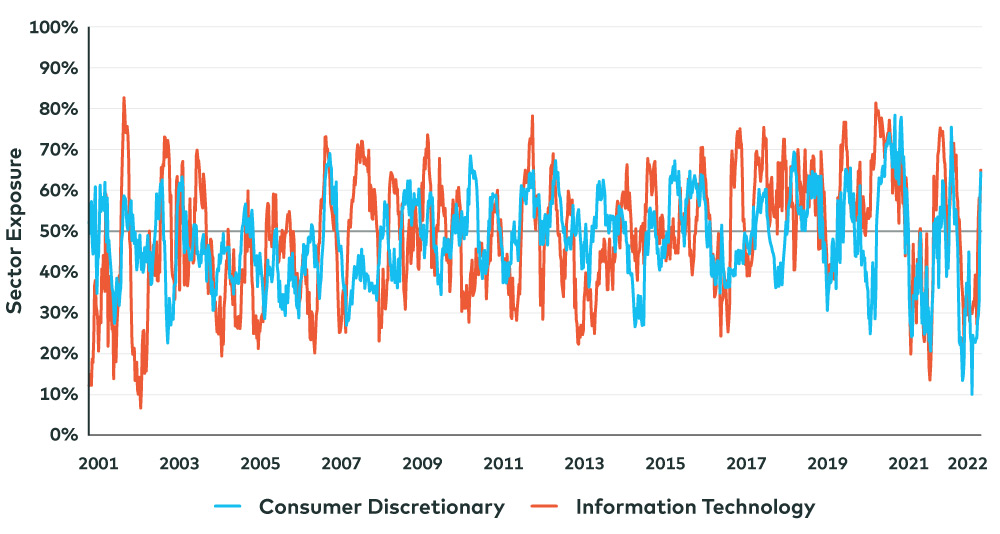

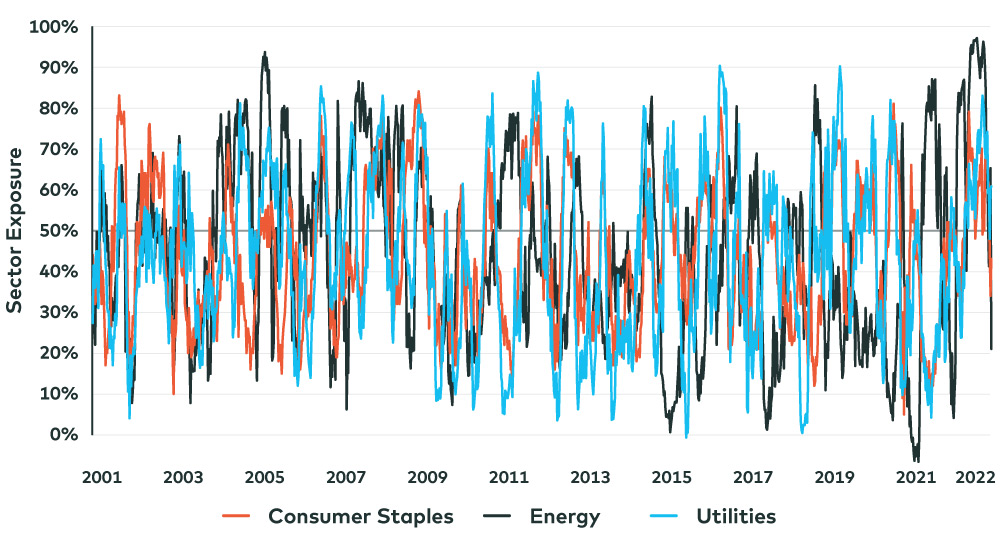

Momentum Shift

In the previous blog of this series, momentum stocks were highlighted for their extreme volatility as well as their makeup as it relates to underlying factors. Since then, the performance of momentum stocks has normalized – especially when considering changes over a three-month period. For example, momentum’s exposure to the consumer discretionary and information technology sectors was abnormally low earlier this year, but has almost returned to normal and could be moving towards an opposite extreme of abnormally high exposure to these sectors in the short term (see illustration 2). Similar dynamics are in play for sectors like consumer staples, utilities and energy, albeit in reverse. Instead of moving from low-to-high, momentum exposure to these sectors has fallen dramatically from where it was just a few months ago.

Sector Exposures of U.S. Momentum Stocks

Source: AGFiQ using data from FactSet as of August 10, 2022. Three-month price change exposure of sectors in the top 1,200 securities in the U.S. by market cap.

Putting all this together, there is still room for many of the extremes we saw in the first half of the year to continue to normalize. But given where we are in the business cycle, there is a high probability for investors to expect more factor volatility and sharp reversals in short-term performance extremes.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of September 2, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

References to specific securities are presented to illustrate the application of our investment philosophy only and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by AGF Investments.

AGFiQ is a quantitative investment platform powered by an intellectually diverse, multi-disciplined team that combines the complementary strengths of investment professionals from AGF Investments Inc. (AGFI), a Canadian registered portfolio manager, and AGF Investments LLC (AGFUS), a U.S. registered adviser.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” and ™ “AGFiQ” logos are registered trademarks of AGF Management Limited and used under licence.

20220908-2411546

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2025 AGF Management Limited. All rights reserved.