Value Outperforms and Other Extremes Defining Markets So Far This Year

Author: Abhishek Ashok

April 27, 2022

Every month, AGFiQ highlights the investment factors that are helping shape equity markets. Today’s focus is a look back on the first few months of the year and the extreme performance of certain factors and sectors over that time.

Equity investors may not be keen to rehash the first few months of 2022. After all, the selloff in major equity indexes marks one of the worst starts to a year in recent memory. But that doesn’t mean they should turn a blind eye to what has already transpired. In fact, when it comes to the extreme performance of some factors – as well as sectors of the market – the more that’s understood, the more prepared investors will be for how stock returns might unfold moving forward.

Value’s Outperformance

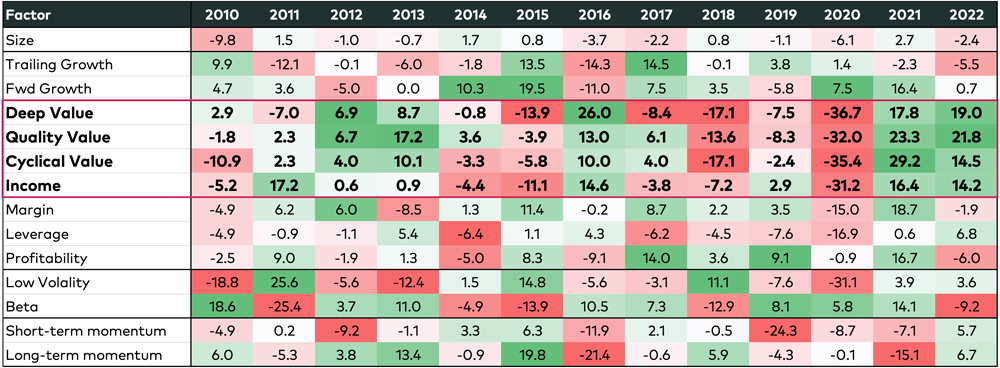

As a starting point, one of the most unique aspects of the first quarter this year was the outperformance of value in relation to other factors such as size, growth, quality and momentum. According to AGFiQ research, stocks that exhibited strong value metrics provided the best relative gains by far, while the worst performing stocks were those associated with the factor known as short-term beta and, therefore, defined as those that move in lockstep with the broader market.

Relative Factor Performance

More surprising than value’s outperformance in relation to other factors, however, is the fact that it did so well at a time when equity markets did so poorly. Again, based on our research, value stocks only outperformed 2% of the time since 2003 when markets sold off more broadly and almost always had negative returns instead.

Narrow Sector Leadership

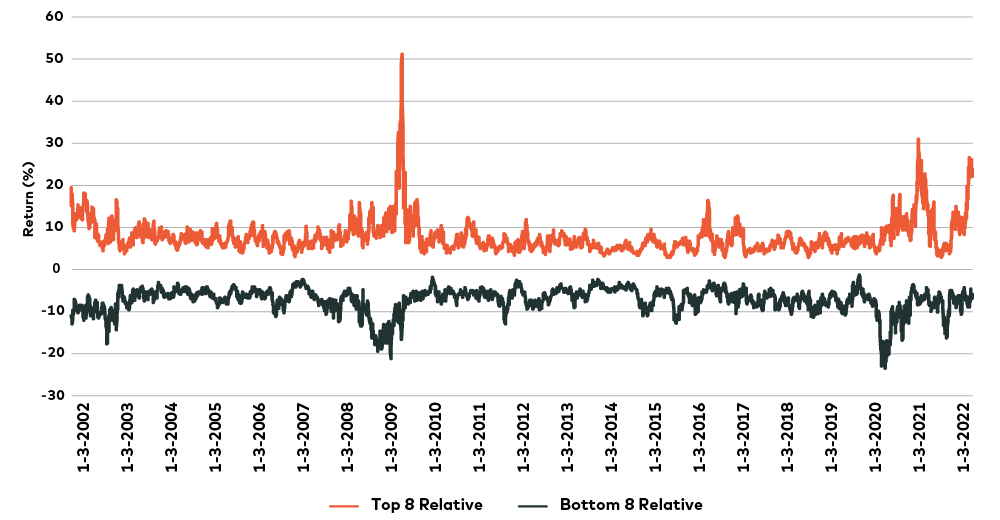

Another important aspect of the first quarter was the dispersion of returns from a sector perspective. Our analysis of 26 custom subsectors shows the spread between the eight best and eight worst performing sectors was close to 40% and almost double the historical average of one standard deviation.

Relative Sub-Sector Performance Spread

Our sector analysis also shows there was significant dispersion of returns when considering the “cheapest” sectors based on both book-to-price and forward earnings metrics. For example, U.S. banks had the most attractive book-to-price valuation in the first quarter, but its relative three-month price return was negative. U.S. insurance companies, meanwhile, were the second-most attractive sector from a book-to-price standpoint and had a relative three-month price return of 13.9%.

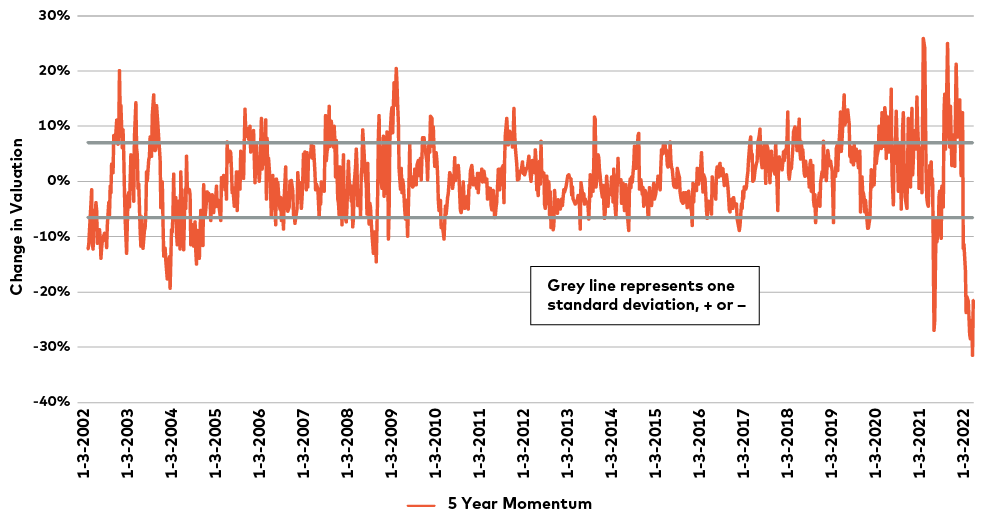

The De-Rating of Momentum and Quality

Beyond that, two other extremes worth noting are the trading premiums associated with both momentum and quality stocks. Of the first, long-term winners have de-rated at an unprecedented pace relative to the market and were trading at less than a 50% premium versus the market at the end of the first quarter, down from close to 125% last November. Moreover, the three-month change in relative valuation of long-term momentum stocks was more than 30% or four times greater than the average historical three-month valuation change of 7%, plus or minus.

Relative Valuation of Momentum Stocks

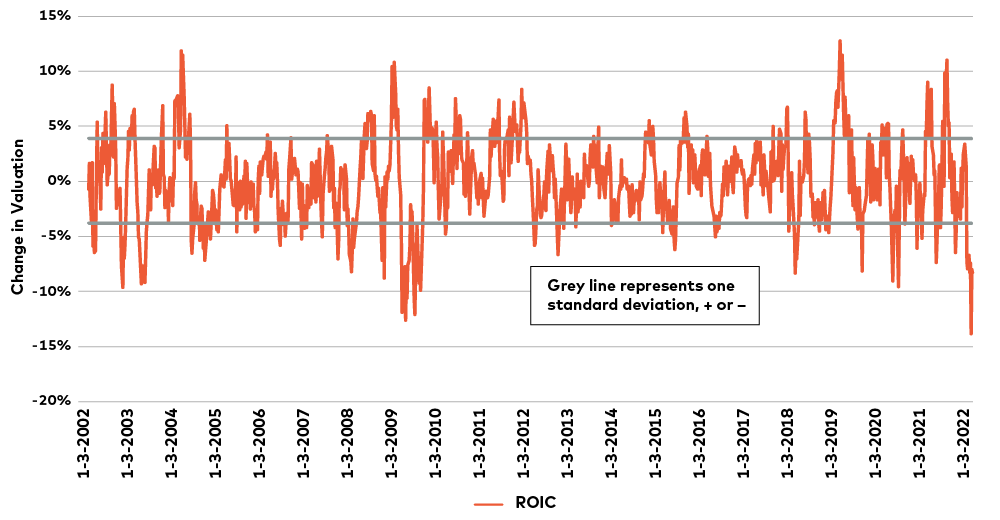

As for quality stocks, they have recently de-rated in significant fashion as well, and now trade closer to their average premium above market (two to 10%) after trading closer to a 20% premium earlier this year. This move, over a rolling three-month period, is close to four times greater than the 4% valuation change through history.

Relative Valuation of Quality Stocks

All in, then, markets have been defined by several extremes so far this year, many of which could normalize and create potential opportunities for investors in the weeks ahead. In particular, value’s outperformance is likely to cool in relation to other factors and the intersection of the highest quality and best long-term momentum stocks may end up being a tactical advantage within the context of a balanced portfolio that continues to include exposures to multiple factors.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of April 22, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

References to specific securities are presented to illustrate the application of our investment philosophy only and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by AGF Investments.

AGFiQ is a quantitative investment platform powered by an intellectually diverse, multi-disciplined team that combines the complementary strengths of investment professionals from AGF Investments Inc. (AGFI), a Canadian registered portfolio manager, and AGF Investments LLC (AGFUS), a U.S. registered adviser.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” and ™ “AGFiQ” logos are registered trademarks of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. AGF brings a disciplined approach to delivering excellence in investment management through its fundamental, quantitative, alternative and high-net-worth businesses focused on providing an exceptional client experience. AGF’s suite of investment solutions extends globally to a wide range of clients, from financial advisors and individual investors to institutional investors including pension plans, corporate plans, sovereign wealth funds and endowments and foundations.

For further information, please visit AGF.com.

© 2024 AGF Management Limited. All rights reserved.