Yes, Markets Are Oversold. But Investors Still Need to Be Cautious

Author: Abhishek Ashok

November 24, 2022

Every month (or so), AGFiQ highlights the quantitative investment factors that are helping shape equity markets. Today’s focus is oversold conditions and the risk of weakening economic and earnings data.

Equity markets may continue to rally from oversold conditions in the near term despite weakening economic and corporate earnings data that could limit future gains and lead to more volatility ahead.

In fact, according to AGFiQ’s latest analysis, several facets of the market remain deeply depressed and could garner further support from investors who believe them to be underperforming at an unreasonable extreme.

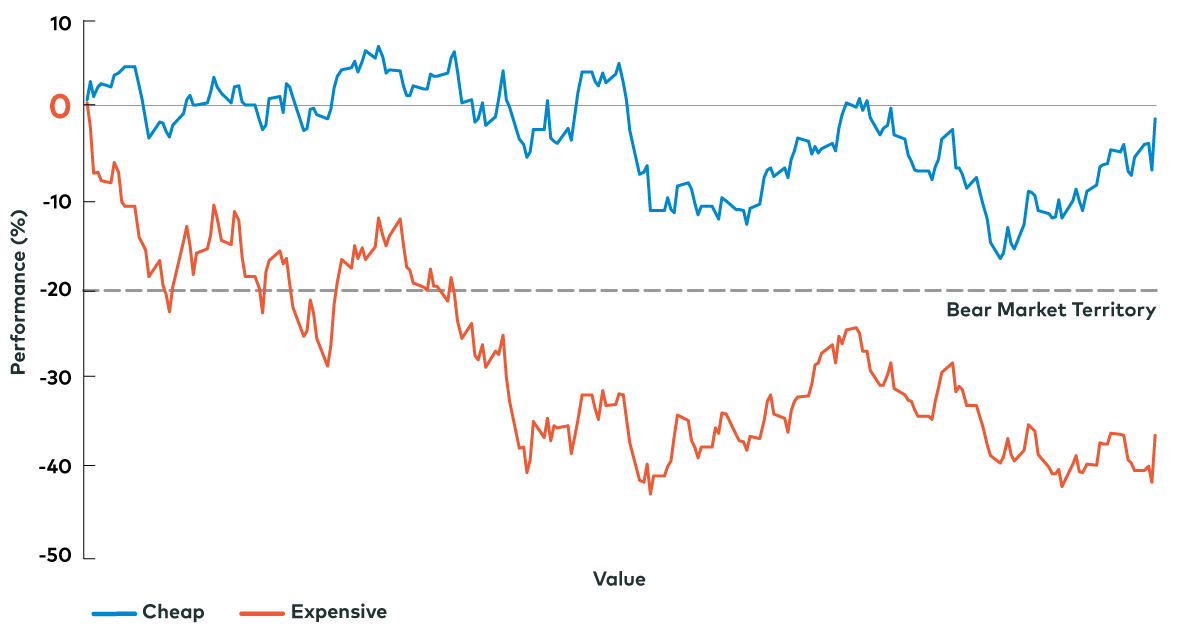

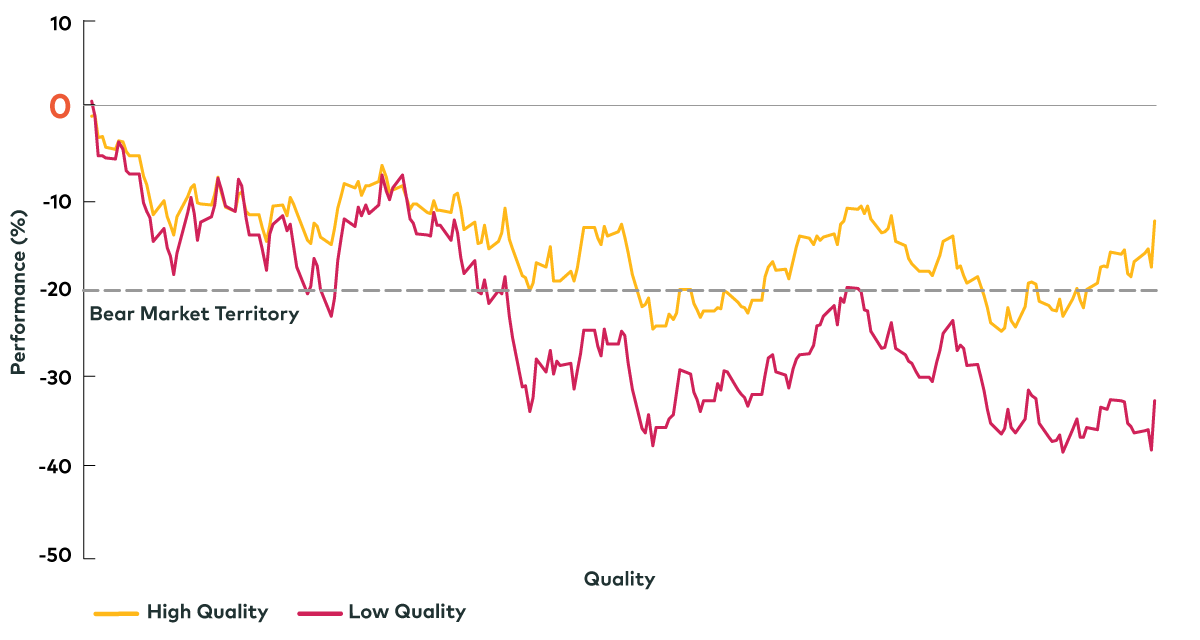

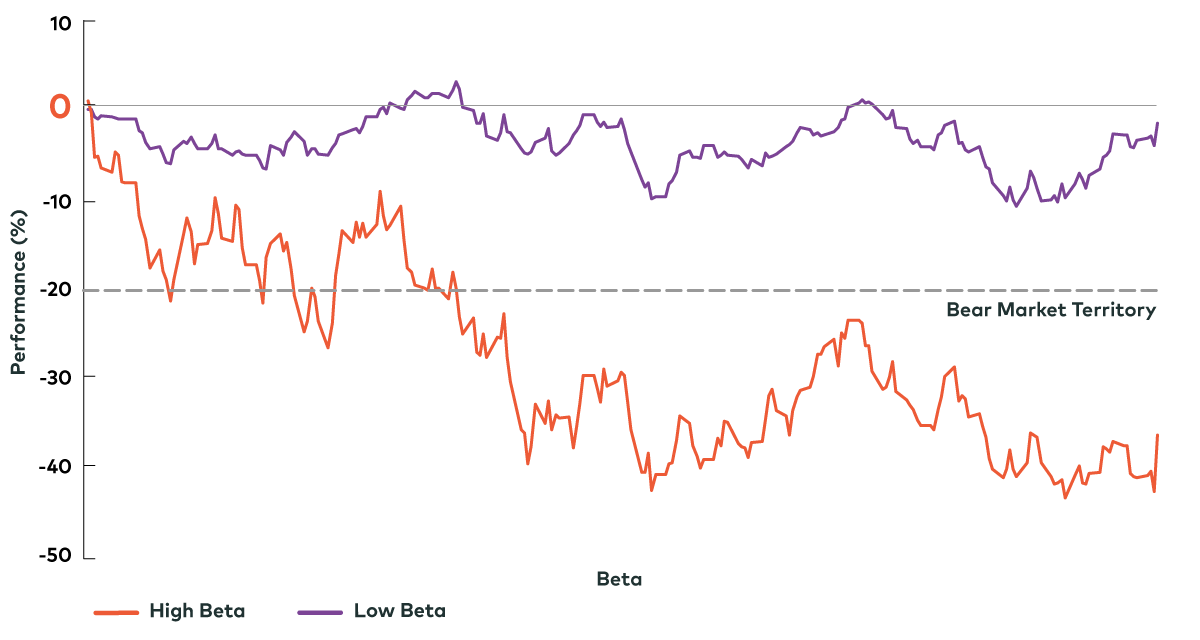

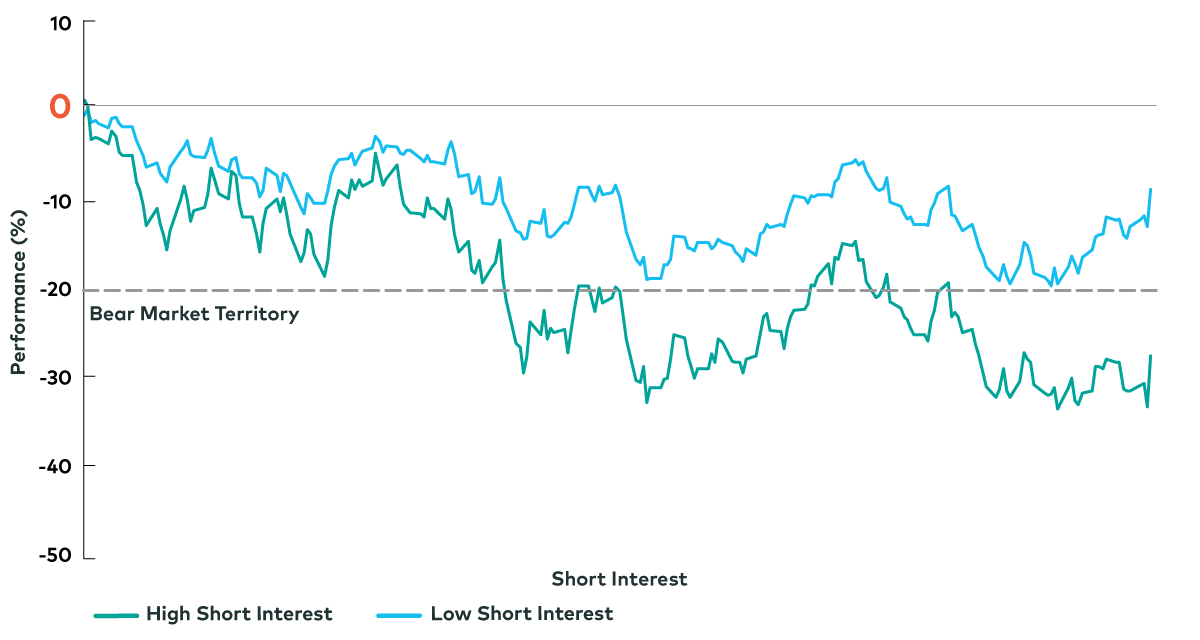

For instance, U.S. equities deemed expensive (from a value perspective) or low quality are among the most oversold, as are those characterized as high-beta names and those that attract the most short-selling interest from investors (see chart 1). In each of these cases, losses have been far more than the broad U.S. equity market, which has been down as much as 25% and fallen into bear market territory on two separate occasions year-to-date.

Oversold Conditions by Factor

Source: AGFiQ using data from FactSet as of November 10, 2022. Cumulative year-to-date returns of the top and bottom 20% of stocks ordered by the respective characteristic within the largest 1,200 securities in the United States

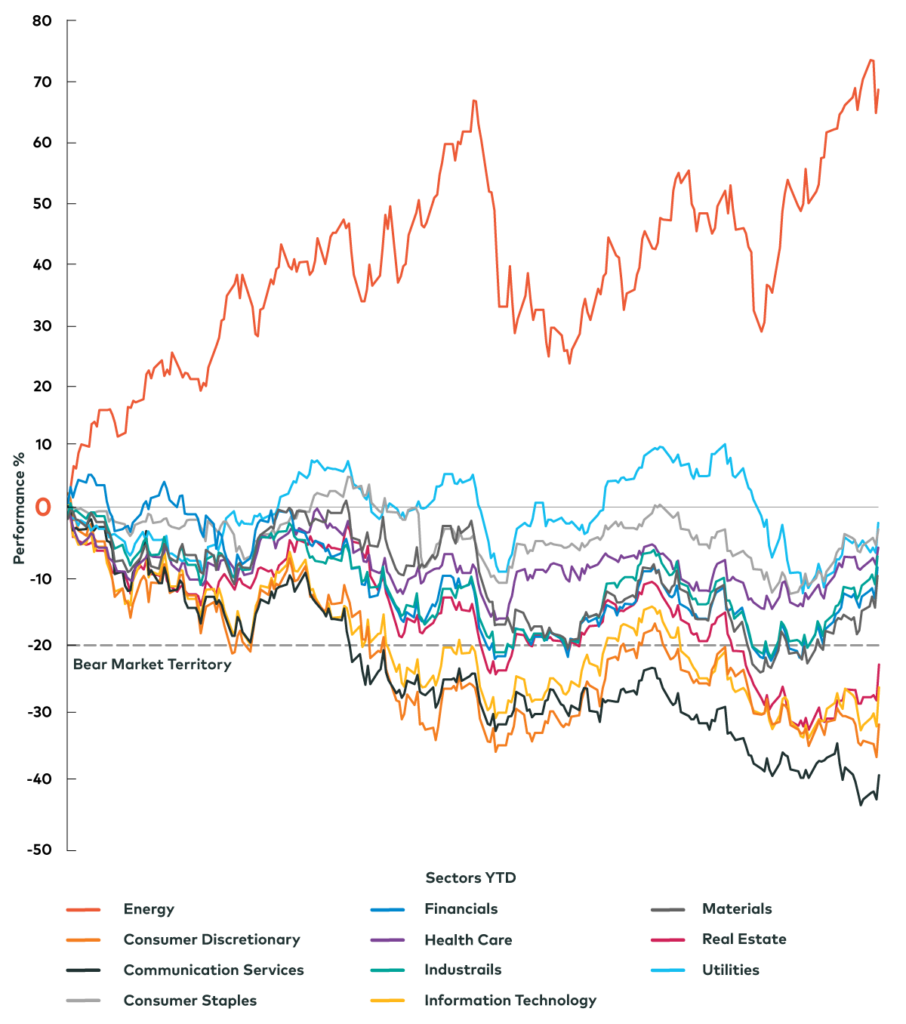

Similarly, some sectors of the U.S. equity market are equally oversold (or almost as much), including, most notably, communications services, consumer discretionary, information technology and real estate. Unsurprisingly, many stocks within these sectors are characterized by higher valuation (i.e. they’re expensive) and higher beta profiles, as well as heightened sensitivity to higher interest rates.

Oversold Conditions by Sector

Source: AGFiQ using data from FactSet as of November 10, 2022. Cumulative year-to-date returns of sectors within the largest 1,200 securities in the United States.

Of course, how much these oversold factors and sectors can rally from here largely depends on the evolving macro backdrop for stocks. Our research shows that the future performance of high-beta stocks may be hindered by the deterioration in U.S. Purchasing Manager Indexes (PMIs), which have fallen from the four-decade high in March 2021 to just above 50 in recent months.

(Note: PMIs measure the prevailing direction of economic trends in manufacturing. A PMI above 50 represents an expansion when compared with the previous month while a PMI reading under 50 represents a contraction.)

While this level is still deemed a signal of an expanding economy, the direction PMIs have taken of late clearly marks a significant deceleration in the pace of economic expansion. Moreover, they may have further to fall before bottoming despite easing pressures on inputs (i.e. supply chains and prices) as well as strong employment and production offsetting somewhat softer demand. After all, based on our research over the past 40 years, PMIs typically bottom lower (signifying a slightly deeper economic contraction than average) following an aggressive tightening by the U.S. Federal Reserve – like what is happening now.

Beyond that, earnings revisions may be another headwind that keeps a lid on the potential for markets to rally much more from here.

Again, our research shows a rapid decline in the breadth of estimate revisions this year and only about 30% of stocks have had their earnings revised upwards (through October), while 70% have been revised down. And not only that, the magnitude of upward revisions has also fallen significantly, while the magnitude of downward revisions is getting larger.

Given this dynamic, it’s not surprising that most of the worst performing sectors mentioned above – communication services, information technology, consumer discretionary – are the ones with some of the worst downward earnings revisions to date.

Perhaps that suggests the worst is over for these sectors, but further estimate revisions to the downside should be expected as the current cycle progresses – at least if history is any guide.

All in then, the combination of extreme oversold conditions, incrementally improving price pressures and the potential overshoot in earnings pessimism could help push equity markets higher in the near term. However, investors should remain cautious as the economic and earnings backdrop continues to evolve. In this environment, a balanced approach to both high- and low-beta stocks and a continued focus on higher quality names may help investors take advantage of potential upside in markets while also navigating the risk of greater volatility to come.

The views expressed in this blog are those of the authors and do not necessarily represent the opinions of AGF, its subsidiaries or any of its affiliated companies, funds, or investment strategies.

The commentaries contained herein are provided as a general source of information based on information available as of November 18, 2022 and are not intended to be comprehensive investment advice applicable to the circumstances of the individual. Every effort has been made to ensure accuracy in these commentaries at the time of publication, however, accuracy cannot be guaranteed. Market conditions may change and AGF Investments accepts no responsibility for individual investment decisions arising from the use or reliance on the information contained here.

This document may contain forward-looking information that reflects our current expectations or forecasts of future events. Forward-looking information is inherently subject to, among other things, risks, uncertainties and assumptions that could cause actual results to differ materially from those expressed herein.

References to specific securities are presented to illustrate the application of our investment philosophy only and do not represent all of the securities purchased, sold or recommended for the portfolio. It should not be assumed that investments in the securities identified were or will be profitable and should not be considered recommendations by AGF Investments.

AGFiQ is a quantitative investment platform powered by an intellectually diverse, multi-disciplined team that combines the complementary strengths of investment professionals from AGF Investments Inc. (AGFI), a Canadian registered portfolio manager, and AGF Investments LLC (AGFUS), a U.S. registered adviser.

AGF Investments is a group of wholly owned subsidiaries of AGF Management Limited, a Canadian reporting issuer. The subsidiaries included in AGF Investments are AGF Investments Inc. (AGFI), AGF Investments America Inc. (AGFA), AGF Investments LLC (AGFUS) and AGF International Advisors Company Limited (AGFIA). AGFA and AGFUS are registered advisors in the U.S. AGFI is registered as a portfolio manager across Canadian securities commissions. AGFIA is regulated by the Central Bank of Ireland and registered with the Australian Securities & Investments Commission. The subsidiaries that form AGF Investments manage a variety of mandates comprised of equity, fixed income and balanced assets.

® The “AGF” and ™ “AGFiQ” logos are registered trademarks of AGF Management Limited and used under licence.

About AGF Management Limited

Founded in 1957, AGF Management Limited (AGF) is an independent and globally diverse asset management firm. Our companies deliver excellence in investing in the public and private markets through three business lines: AGF Investments, AGF Capital Partners and AGF Private Wealth.

AGF brings a disciplined approach, focused on incorporating sound, responsible and sustainable corporate practices. The firm’s collective investment expertise, driven by its fundamental, quantitative and private investing capabilities, extends globally to a wide range of clients, from financial advisors and their clients to high-net worth and institutional investors including pension plans, corporate plans, sovereign wealth funds, endowments and foundations.

Headquartered in Toronto, Canada, AGF has investment operations and client servicing teams on the ground in North America and Europe. AGF serves more than 800,000 investors. AGF trades on the Toronto Stock Exchange under the symbol AGF.B.

For further information, please visit AGF.com.

© 2024 AGF Management Limited. All rights reserved.